Looking for tips to access the Nevada Unemployment Insurance Benefits?

In this article, we will make Unemployment Insurance Benefits easy to understand with Nevada Unemployment phone numbers and other contact information.

We understand.

The experience of unemployment is often fraught with anxiety and feelings of worthlessness. Not being able to provide for oneself and one’s family can be very difficult, and the stress of the situation can be overwhelming.

Those who are unemployed may feel like they are a burden to their loved ones, and they may feel like they are not good enough or valuable enough. It is important to remember that you are not alone in this experience, and there are people who care about you and want to help.

You are valuable, even if you are not working at the moment. There are many resources available to you, so please do not hesitate to reach out for help.

Why did we create the Maine Unemployment Insurance Benefits Guide?

Government websites can be difficult to navigate for a lot of people. They may be confusing or hard to use, and they may not have all the information people need. This can be frustrating and overwhelming, especially for people who are already struggling.

Having said that, please use our guide as support but NOT the official guide. You will NEED to contact the official unemployment government staff and fight for your own benefits. You can do this.

Who’s in charge of Nevada Unemployment Insurance Benefits?

Unemployment Insurance is administered by the Nevada Department of Employment, Training, and Rehabilitation (DETR). Unemployment insurance benefits in Nevada give temporary financial support to jobless employees who have lost their jobs due to no fault of their own and who also fulfill certain other criteria.

Employers in Nevada pay all costs of unemployment aid through an employer tax, which is administered by the Nevada Employment Security Division. This initiative is not funded by a deduction from employee pay.

You might also like:

- North Carolina Unemployment Insurance Benefits Guide 2024

- Nebraska Unemployment Insurance Benefits Guide 2024

- Ultimate Guide To Short Term Disability in Nevada 2024

- 82 Nevada Facts and Weird Laws

- New Mexico Unemployment Insurance Benefits Guide 2024

Nevada Unemployment Contact

UI Claim Information, Related Questions and Telephone Filing

Northern Nevada:

- Tel: (775) 684-0350

- Fax: (775) 684-0338

Southern Nevada:

- Tel (702) 486-0350

- Fax (702) 486-7987

Rural Areas and Out of State Callers:

- Tel: (888) 890-8211 (Toll Free)

Nevada Relay

- 711 or 800-326-6868

- Auxiliary aids and services available on request by individuals with disabilities.

Unemployment Insurance Appeals Offices

Southern Nevada:

- Tel: (702) 486-7933

- Fax: (702) 486-7949

Southern Nevada:

- Tel: (866) 626-0629 (Toll-Free)

Login or PIN Assistance ONLY

Northern Nevada:

- Tel: (775) 687-6838

Southern Nevada:

- Tel: (702) 486-3293

(Note: Monday through Friday, 8:00am to 5:00 pm, except holidays)

- Nevada Department of Employment, Training and Rehabilitation (DETR)

500 East Third Street

Carson City, NV 89713

How To Qualify for Nevada Unemployment Benefits

Nevada citizens must fulfill each of the following conditions to be eligible for UI benefits:

- Unemployed people (through no fault of the claimant)

- During the last 12 months, I worked in Nevada.

- Earned a certain amount of money, as established by Nevada law.

- During each week that UI benefits are requested, you are actively looking for work.

If you live outside of Nevada, you must register with Nevada JobConnect or another local Job Service to be eligible for unemployment benefits.

You might also like:

- Housing Assistance for Veterans With Bad Credit

- How to get Low Income Housing With No Waiting List in Nevada

- New Mexico Unemployment Insurance Benefits Guide

- Housing For Seniors On Social Security

- How to get Low Income Housing With No Waiting List in New Mexico

How Much Unemployment Benefits Will I Get in Nevada?

- Base Period: First 4 of the last 5 completed quarters

- Alt Base Period: Last 4 completed quarters

- Duration of Benefits: 8-26 weeks

- Weekly Payment: Min $16 to Max $483

- Maximum Benefits Amount (1 year): $12,194

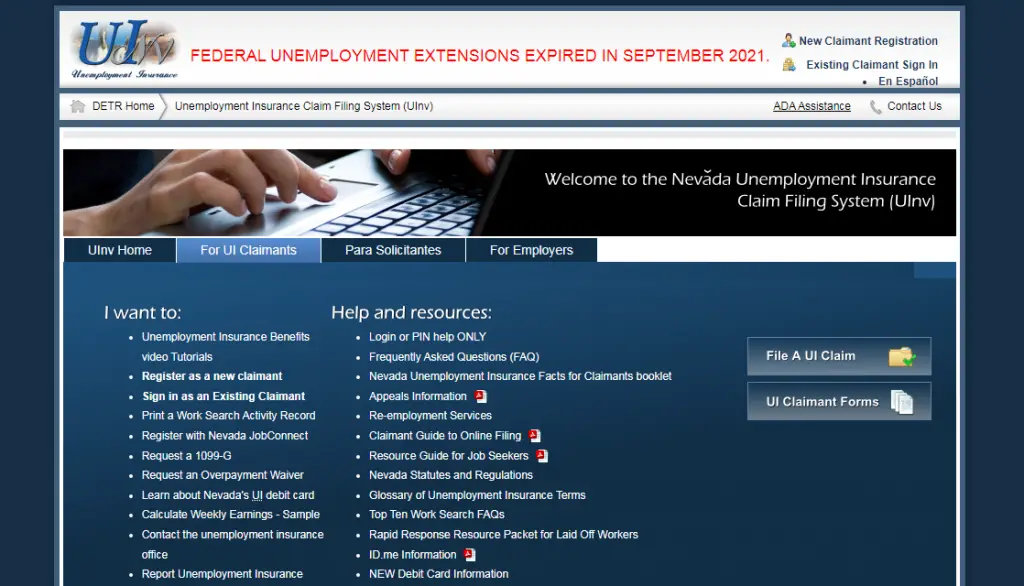

How Do I Apply for Nevada Unemployment Benefits?

The Claimant Self Service portalin Nevada is the quickest way for a worker to make an unemployment compensation claim. If you do not have access to the Internet, you can file by contacting any of Nevada’s Telephone Claim Centers between the hours of 8 a.m. and 8 p.m. Monday through Friday.

The following are the contact numbers for the call center:

- Northern UI Call Center: 775-684-0350

- Southern UI Call Center: 702-486-0350

- Rural areas and Out-of-State: 888-890-8211

When phoning, be prepared to wait a long time. You are highly urged to file your claim online, which you may do at your leisure at any time. You may be placed on virtual hold during times of heavy call volume, which allows you to keep your place in the line without having to wait on the phone.

You might also like:

- Arkansas Unemployment Insurance Benefits Guide

- North Carolina Unemployment Insurance Benefits Guide

- Missouri Unemployment Insurance Benefits Guide

- New Mexico Unemployment Insurance Benefits Guide

- Nebraska Unemployment Insurance Benefits Guide

How do I Manage My Nevada Unemployment Benefits

You must file a weekly unemployment insurance claim for each week that you desire unemployment benefits. After the week is up, you’ll be asked to answer a series of questions regarding your job search activity online or over the phone. Choose one of the ways below:

- Online: Select File Weekly Claim after logging into your CSS account

- Northern UI Call Center: 775-684-0350

- Southern UI Call Center: 702-486-0350

- Rural Areas and Out-of-State: 888-890-8211

Select option 1 from the menu when filing your weekly claim by phone. Please be aware that, as with making an initial claim, Nevada’s phone centers frequently encounter excessive call volume. You may face a long wait period and be placed on virtual hold to maintain your position in the line.

You might also like:

- Missouri Unemployment Insurance Benefits Guide

- Rhode Island Unemployment Insurance Benefits Guide

- Maine Unemployment Insurance Benefits Guide

- Senator Salaries and Benefits

- Ultimate Guide to Contact Senators

How Do I Appeal a Nevada Unemployment Decision?

If you disagree with a decision about your claim, you have 11 days from the day your claim denial is mailed to file an appeal. The particular processes for filing an appeal will be outlined in your determination letter.

The Nevada appeals procedure is intended to give a fair and unbiased hearing to further investigate an unemployment insurance claim.

You or someone you designate as an authorized agent must submit your appeal request in writing and sign it. Your entire name, address, and Social Security number should also be included.

Following the submission of your appeal, a state-employed impartial Appeals Referee will hold a hearing in which you will be requested to participate.

Two to three weeks after your hearing, the Appeals Referee will provide a revised ruling. The judgment of the Appeals Referee can then be appealed to Nevada’s Board of Review, provided the request is made within 11 days after the Appeals Referee’s ruling.

You might also like:

- New Mexico Unemployment Insurance Benefits Guide

- Arkansas Unemployment Insurance Benefits Guide

- 82 Nevada Facts and Weird Laws

- Nebraska Unemployment Insurance Benefits Guide

- North Dakota Unemployment Insurance Benefits Guide

How Do I Report a Nevada Unemployment Fraud?

Unemployment insurance fraud is a serious crime in Nevada, and it includes everything from making false statements on a benefit claim to withholding information in order to obtain benefits, as well as failing to report employment and income during the week for which unemployment benefits are claimed.

Filing an unemployment claim while jailed, permitting someone person to do so on your behalf, or claiming UI benefits under a name or Social Security number other than your own are all examples of fraud.

If you suspect fraud, you may report it online or call 775-684-0475 and pick option 4 from the automated menu.

What if I quit?

In general, you are not eligible if you leave your work freely.

If you quit for “good cause,” though, you may be able to collect. The state unemployment office determines what constitutes good reason, and you can make your case for getting benefits.

You should be entitled to a hearing if your claim is denied so that you can explain your claim. You should contact your local office because regulations and conditions differ from state to state.

Similar Content

- Massachusetts Unemployment Insurance Benefits Guide

- Michigan Unemployment Insurance Benefits Guide

- Minnesota Unemployment Insurance Benefits Guide

- Mississippi Unemployment Insurance Benefits Guide

- Missouri Unemployment Insurance Benefits Guide

Nevada Unemployment Phone Number and Office Locations

| Nevada Unemployment Office | Nevada Unemployment Office Locations | Nevada Unemployment Phone Number |

| NV Unemployment Career Center | 6330 W Charleston BlvdLas Vegas, NV 89146 | 702-822-4200 |

| NV Unemployment Office North Las Vegas | 2827 Las Vegas Boulevard NorthNorth Las Vegas, NV 89030 | 702-486-0200 |

| NV Unemployment Office – Pahrump | 1020 E Wilson RdPahrump, NV 89048 | 775-727-9970 |

| NV Unemployment Office – Reno | 4001 South Virginia StreetReno, NV 89502 | 775-284-9600 |

| NV Unemployment Office – Reno | 1090 East 8th StreetReno, NV 89512 | 775-786-6023 |

| NV Unemployment Office – Sparks | 2281 Pyramid WaySparks, NV 89431 | 775-284-9520 |

| NV Unemployment Office – Winnemucca | 475 W. Haskell Street Suite CWinnemucca, NV 89445 | 775-623-6520 |

Final Thoughts

We hope the above info has been helpful to you.

We do not make any financial advice but below are some of our thoughts that could help you stand on your feet sooner than later.

- Don’t feel shame about needing help, but also don’t feel entitled.

- Don’t beat yourself up – things happen. The sooner you accept it and move on, the better.

- Don’t burn the bridge. Work with your employer to help yourself.

- 1) Check if you are entitled to severance pay, vacation or sick pay,

- 2) Ask about extending health insurance benefits,

- 3) Ask about outplacement resources,

- 4) Request a reference letter from your employer

- Review your financial positions, obligations.

- Make a weekly or monthly budget. Buy what you need, so you don’t have to sell what you need.

- Watch out for credit card loans – they will eat you alive.

- Make an action plan with at least 3 scenarios from best to worst and examine your options.

Related Content: