For years, many people have been taking advantage of online shopping’s nifty feature – instant credit online shopping no down payment. It’s a common sight in pretty much every digital store you visit these days. Well, most of them offer you the chance to split your payments and snag your goodies right away.

Now, they’ve got this fancy name for it, and it’s called “buy now, pay later.” These companies handing out this option don’t always snoop around your credit history, but be punctual with your payments if you want to steer clear of any hiccups.

Don’t forget, there’s a whole bunch of apps that let you roll with the buy now, pay later gig. You can spot this payment option and credit lines in various online haunts.

But let’s not overlook the big kid in the playground – Amazon. Yep, they’ve got some sweet buy now, pay later action going on, and it’s a top-tier spot for this payment method.

Table of Contents

What Is The Process For Instant Credit Online Shopping With No Down Payment?

Many websites now provide a convenient option to buy items without first making a down payment. The practice, known as “instant credit online shopping,” has proven to be very popular among repeat buyers. A service provider will typically allow you to make modest payments over time rather than one large one.

Some lenders are laid-back and won’t even check your credit. However, specific retail establishments may provide a different experience. Most businesses will examine your credit history before allowing you to use this payment plan.

They do this to make sure you won’t have any trouble paying off the debt. You may be on the lookout for businesses that don’t check your credit report only because it isn’t perfect. You seek establishments where you may make a quick purchase without forking over a large sum of money.

App to Make Instant Payments on Items with No Credit Check Needed

While credit check apps won’t help improve their credit score since they don’t report to credit agencies, buy now pay later apps come to the rescue for many borrowers looking for flexible installment plans. These apps offer a convenient way to manage their purchases and payments.

1. Klarna

When looking at Klarna compared to competitors like Quadpay, it’s clear that Klarna has a unique payment method. Using this strategy, users can protect their credit ratings from any potential damage.

As a bonus, new customers can get $5 off their first purchase from a store that offers Klarna’s “buy now, pay later” option. It’s worth noting that, contrary to popular belief, Klarna doesn’t guarantee clearance and that there may be limits for new customers.

- The maximum loan amount offered by Klarna lenders varies.

- The maximum interest rate you could be charged is 24.99%, so keep that in mind.

- Repayment periods might be as short as one month or as long as three years.

- Klarna stands apart from the competition in part because it requires no initial payment to use.

2. Affirm

Affirm offers a simple repayment plan for its customers. You must pay the total price in four equal installments, with no interest charged. Affirm is one of the greatest “buy now, pay later” apps available if you want to skip a credit check.

Affirm, however, may be an option for those with less-than-perfect credit. Some essential information is provided here.

- Affirm will lend you up to $17,500.

- Interest rates as high as 30% could apply to your purchases.

- One month to four years (48 months) is the length of time you have to pay back your loan.

- There is no initial cost to join.

- Affirm won’t hit you with any extra charges like application fees or membership fees.

3. SplitIt

This software can only be used in conjunction with a credit card reader and accepts all major credit card brands.

This software allows users to make immediate purchases and schedule later payments without being subject to a credit check. Debit cards are not accepted here. SplitIt won’t give you instant approval for a loan.

- The amount of money you can borrow using this app can vary depending on which platform you’re using.

- There are no extra charges for interest when you make purchases through SplitIt.

- You can pay back what you owe throughout 3 to 24 months. This is one of the most flexible repayment terms available in the market.

- There are no hidden costs like application fees or membership fees with SplitIt.

4. Afterpay

When a person explores options for buy now, pay later services without any credit checks, they might come across an app called Afterpay.

With Afterpay, individuals have a generous timeframe of 6 weeks or even more to settle their purchases when shopping at stores that support this service.

Afterpay is a convenient alternative to traditional financing because it does not affect your credit score and does not record your payment history to credit agencies. However, there are a few factors to consider:

- The minimum required to use Afterpay is a 25% down payment on your transaction.

- Depending on the platform and the lender you go with, the maximum loan amount you could be offered could be different.

- Be advised that there is a late payment fee if you end up having to make a payment late. You’ll have to pay either $8 or 25% of the total amount you borrow.

- It’s worth highlighting once again that Afterpay doesn’t charge any interest on your purchases.

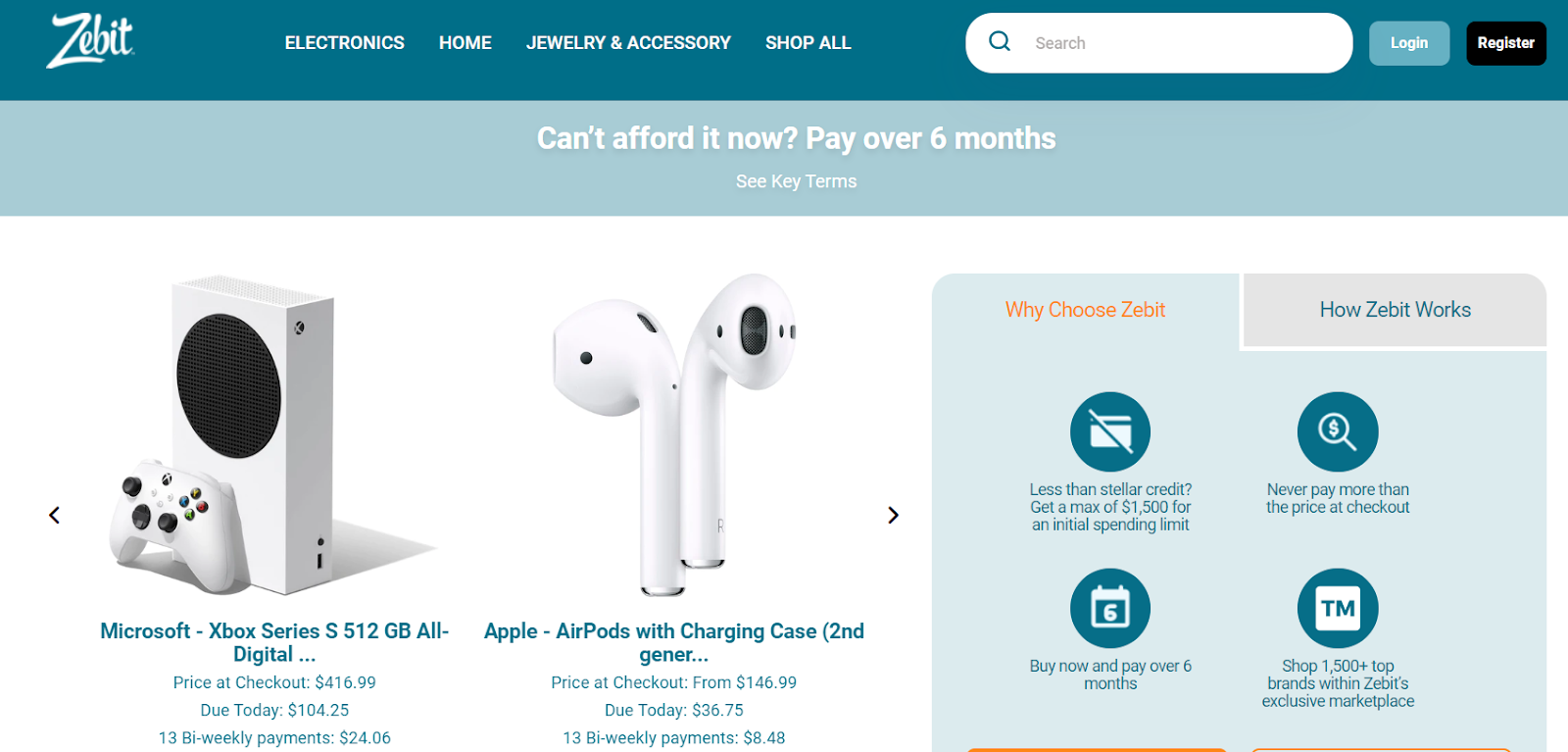

5. Zebit

Zebit provides its customers with access to a vast selection of goods and services without the burden of application fees, membership fees, or late payment costs. A steady income is one of the factors Zebit considers when deciding who can use its services.

Key functions of Zebit include:

- You can spread your payments out across 6 months with Zebit, making it easier to manage your finances.

- Zebit offers personal loans between $1,000 and $25,000, providing you some financial leeway.

- When you make a purchase, there’s a 25% down payment required. This ensures you’re committed to the purchase.

- If you decide to use a gift card, please note that Zebit charges an 18% fee on the total value of the gift card.

- While Zebit can’t guarantee instant approval, the chances of qualifying for their services are quite high.

6. PayPal

This amazing app allows people to pay in four equal installments through a simple repayment plan, without any added interest fees. What’s even better is that there are no extra costs, and this platform provides purchase protection – a feature not commonly found in other similar options we’ve discussed earlier.

That’s probably why PayPal Pay has garnered strong reviews.

- The best part is there are no interest charges involved.

- Plus, your credit score won’t be affected negatively if you happen to make a late payment since PayPal Pay doesn’t report to credit bureaus.

7. Sezzle

The Sezzle app collaborates with several online stores to help people buy things more affordably:

- To start, a person can pick a company from the list of partners and then select the items they want to purchase.

- After making those selections, they can opt for Sezzle as their payment method. Sezzle then breaks down the total cost into four easy-to-manage payments.

- Sezzle also plays nicely with Apple Pay, making transactions even more convenient.

- Sezzle approval doesn’t require buyers to undergo a credit check.

No Credit Check Instant Approval Websites

Buy now, pay later websites enable customers to select their desired items and delay payment, avoiding the need to pay the full amount upfront. Moreover, the good news is that many of the websites we’ve talked about don’t add any extra fees in the form of interest.

The time you get to repay what you owe might differ depending on the store. Additionally, some of these websites even offer the flexibility to settle your bills on a weekly basis instead of a monthly one.

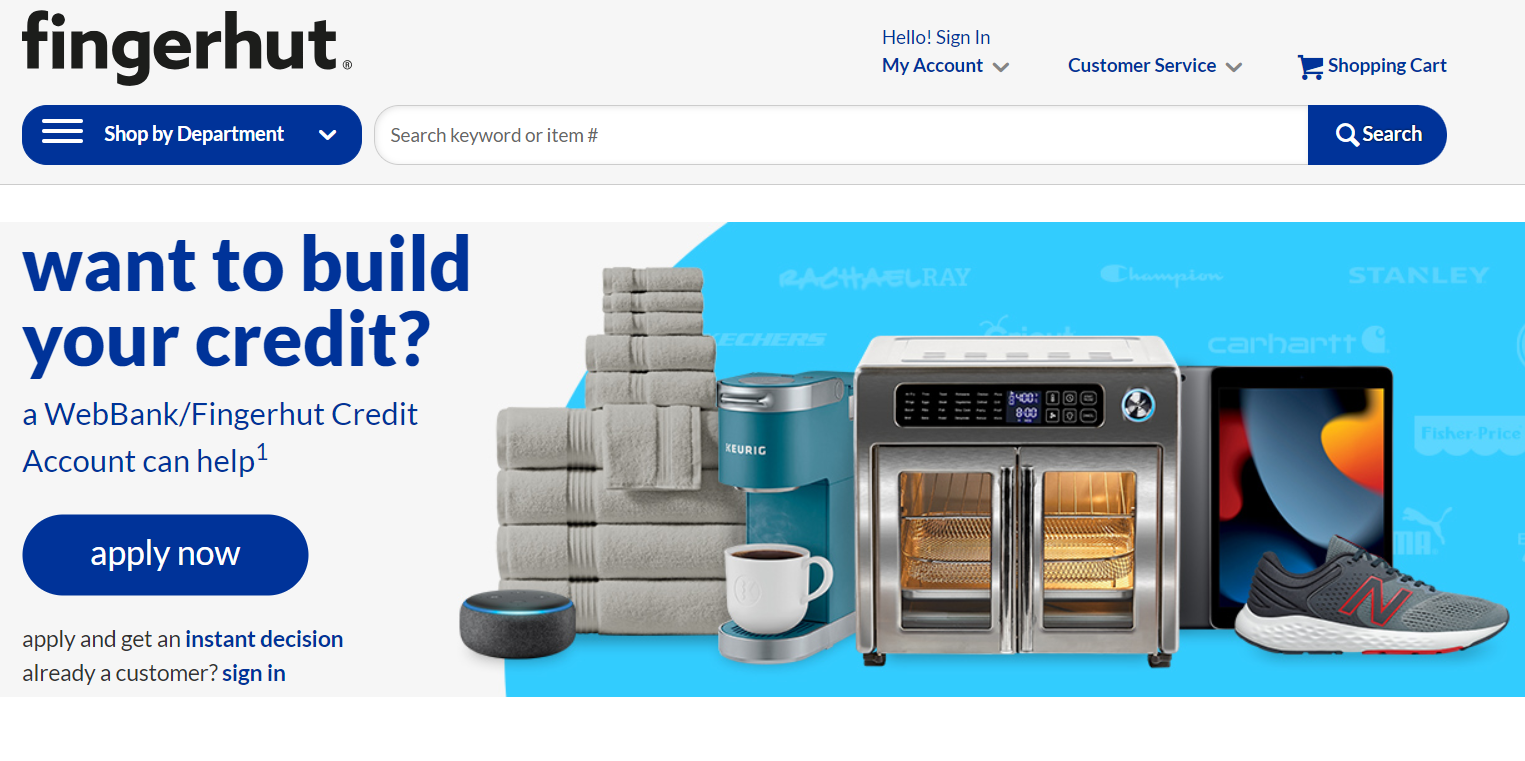

1. Fingerhut

They can complete their purchase on Fingerhut’s website and open an account quickly. When someone becomes a Fingerhut member, they also gain access to a credit card. Fingerhut is a top choice because it reports your credit activity to all three major credit bureaus.

This means it can help you raise your credit score fast if you manage your spending wisely. Just remember not to miss any payment deadlines, and you’re in good shape.

- Fingerhut has a simple and hassle-free application process. A regular credit card and account opening is possible after approval.

- With this card, you may set up automatic monthly payments, simplifying your financial life.

- Fingerhut can help you rebuild your credit by reporting your positive payment history to all three major credit agencies.

- In addition, they stock a large selection of goods, giving you more options than ever before in your shopping excursions.

2. FlexShopper

More than five decades have passed in FlexShopper’s rich and legendary past. They focus on providing a wide variety of items, including electronics, for rent with easy payment schedules.

FlexShopper stands apart from the competition since it does not rely primarily on the services of conventional credit bureaus. Some features of FlexShopper include the following:

- You can satisfy any and all of your furnishing and technological appliance desires.

- A big plus for many clients is that they don’t make selections based only on your FICO score.

- FlexShopper provides a personal shopper service to assist you in your product search if you are unsure of what you need.

- Fast and helpful customer service is a priority for FlexShopper.

- FlexShopper’s website has been a trusted platform for a considerable amount of time, indicating its commitment to providing reliable services over the years.

3. QVC

When people think about QVC, they might not even need to read reviews. This website has received a bunch of awards because it’s super easy to use.

QVC is one of the few internet retailers to offer quick credit without performing a credit check. Getting started is as easy as visiting their website and filling out an application.

After getting everything in order, you’ll have carte blanche to make any purchases you like, so long as you continue to pay on time. Your choice of a debit or credit card is acceptable for payment.

- Some QVC-related facts are as follows.

- A bunch of trophies attest to its awesomeness.

- Credit cards and debit cards are accepted methods of payment.

- It’s simple to sign up.

- Things can be rented by telephone service as well.

- It’s all about giving you quality and convenience.

4. Stoneberry

Stoneberry boasts an extensive collection of buy now, pay later, no credit check electronics available for rent, making it a top choice for those in search of instant approval options. Stoneberry doesn’t stop at electronics; you can also explore its range of home goods, toys, and footwear.

After you submit an online application with Stoneberry, they will check your credit, but that won’t affect their final decision. It doesn’t tell you if your credit is good or bad.

Stoneberry also provides a convenient credit card that can simplify keeping track of payments for rented products on a monthly basis. Here’s a quick recap of what Stoneberry offers:

- An accessible online application process.

- Convenient low monthly payments that won’t break the bank.

- A helpful credit card to simplify your payment process.

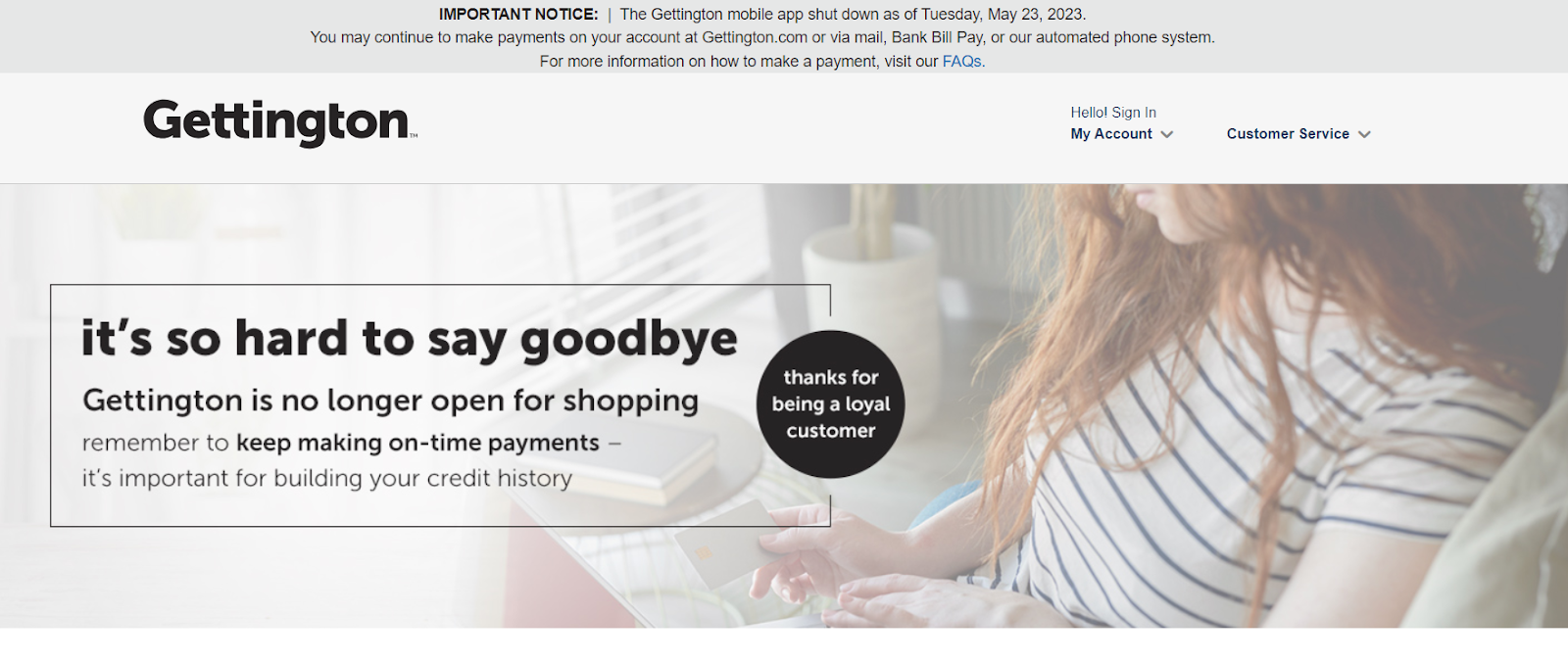

5. Gettington

This option is yet another fantastic choice available online. The website charges some interest on your purchases, but the rates are still much more budget-friendly than other similar sites.

The online application process is simple and quick when accessed through the website. WebBank will analyze the given information and do a credit check after you submit your request.

Gettington also offers the added bonus of free home delivery. You can shop for what you need and rest assured that it will arrive at your home undamaged. Monthly payments are an option for you to consider.

- It has everything from gadgets to furniture to cosmetics.

- The entire application procedure can be completed in a matter of seconds.

- They provide competitive interest rates compared to similar websites.

- You can take advantage of the free home delivery option.

- WebBank carefully manages the eligibility and qualification criteria on the website.

6. HSN

The Home Shopping Network offers a program where you, as a customer, can buy now and pay later with guaranteed approval through Flexpay.

With this plan, you can get the things you want without breaking the bank account by paying for them over time.

If you don’t have the funds to pay for your desired things in full, don’t panic; the monthly installments are calculated to be reasonable. The following perks are yours to enjoy while you embark on your shopping expedition, should you be granted approval:

- HSN’s Flexpay program is an excellent option for spreading out the cost of your purchases.

- You can choose a payment plan that works best for you, whether that’s weekly, biweekly, or monthly installments.

- The online application takes less than two minutes to finish.

- Helpful and kind people staff the customer service department.

- There’s something for everyone among the many options available to you.

7. Seventh Avenue

If someone is interested in getting their hands on fantastic products in categories like furniture, health, beauty, and outdoor settings, they should consider visiting Seventh Avenue.

The credit plans they offer are quite flexible, and some of them even allow you to make monthly payments as low as $80 for products that cost more than $2400.

Moreover, they have monthly installment plans where you can make payments of just $20 in each payment cycle. This website boasts some truly amazing features and products that you won’t easily find elsewhere:

- They provide a convenient personal store credit or debit card to help you manage your finances.

- The store credit cards allow you to select monthly payments as low as $20, which can make budgeting a breeze.

- You can fill out the application and receive approval on the same day, making the process quick and hassle-free.

- The website’s user-friendly layout makes shopping and managing your purchases straightforward.

Can Buy Now Pay Later No Credit Check Websites Affect Your Credit?

When a person owes money, their credit score can take a big hit. It’s a pretty important part of the whole credit score, almost one-third of it! So, if someone is dealing with a not-so-great credit situation and piles up more debt by renting stuff, it’s going to make their credit score even worse.

Now, the bad news is that this credit score drop won’t just pop up overnight. It’ll slowly show up on their credit report over time. If they keep paying their bills on time, that bad effect will start to fade away.

This is good for their reputation with those people who lend money because they’ll see that this person is handling their loans responsibly.

The Bottom Line

These websites offer some of the best options for people looking to buy now and pay later. They’re perfect for those who want flexibility in their payment plans and don’t want to stress about missing due dates.

You won’t have to fret over your credit scores with these websites because they don’t perform credit checks. One standout recommendation is Fingerhut, a reliable choice for online store shopping without credit checks.

The great thing about Fingerhut is that it not only lets you shop without worrying about your credit, but it also helps you rebuild your credit score. Plus, you can use it to pay for rented products without any financial pressure.

Frequently Asked Questions

What are some reliable websites that let you buy now and pay later and do not do credit checks?

Fingerhut, FlexShopper, and Gettington are just a few examples of online purchases that enable you to make purchases and pay for them in installments; more possibilities are listed above.

Where can I find buy now pay later with bad credit?

Websites like CashUSA.com provide easy access to bad-credit buy-now-pay-later loans for those in need of financial assistance.

Does Walmart offer by now, pay later guaranteed approval?

Walmart is receptive to several BNPL options, including Affirm and ZIP. While none of these methods can ensure acceptance, applications are rarely denied.