Do you worry about your credit score? Here are the best credit monitoring services for low-income families to help you secure your finances.

Today, financial challenges are an everyday reality for many families. Rising living costs and unexpected expenses make it difficult to maintain a healthy credit score. These pressures may push you to seek solutions that can help manage your credit.

Credit monitoring services have emerged as a solution. These services track your credit reports and alert you to change, such as:

- New accounts opened in your name

- Large purchases

- Missed payments.

More than 100 million people in the US turned to credit monitoring services between 2018 and 2023. This is according to a global study by TransUnion. The surge highlights a growing awareness of the importance of credit management.

We’ve reviewed the available credit monitoring services to help you choose the best. Read on.

Table of Contents

Best Credit Monitoring Services For Low-Income Families

Here are the top credit monitoring services:

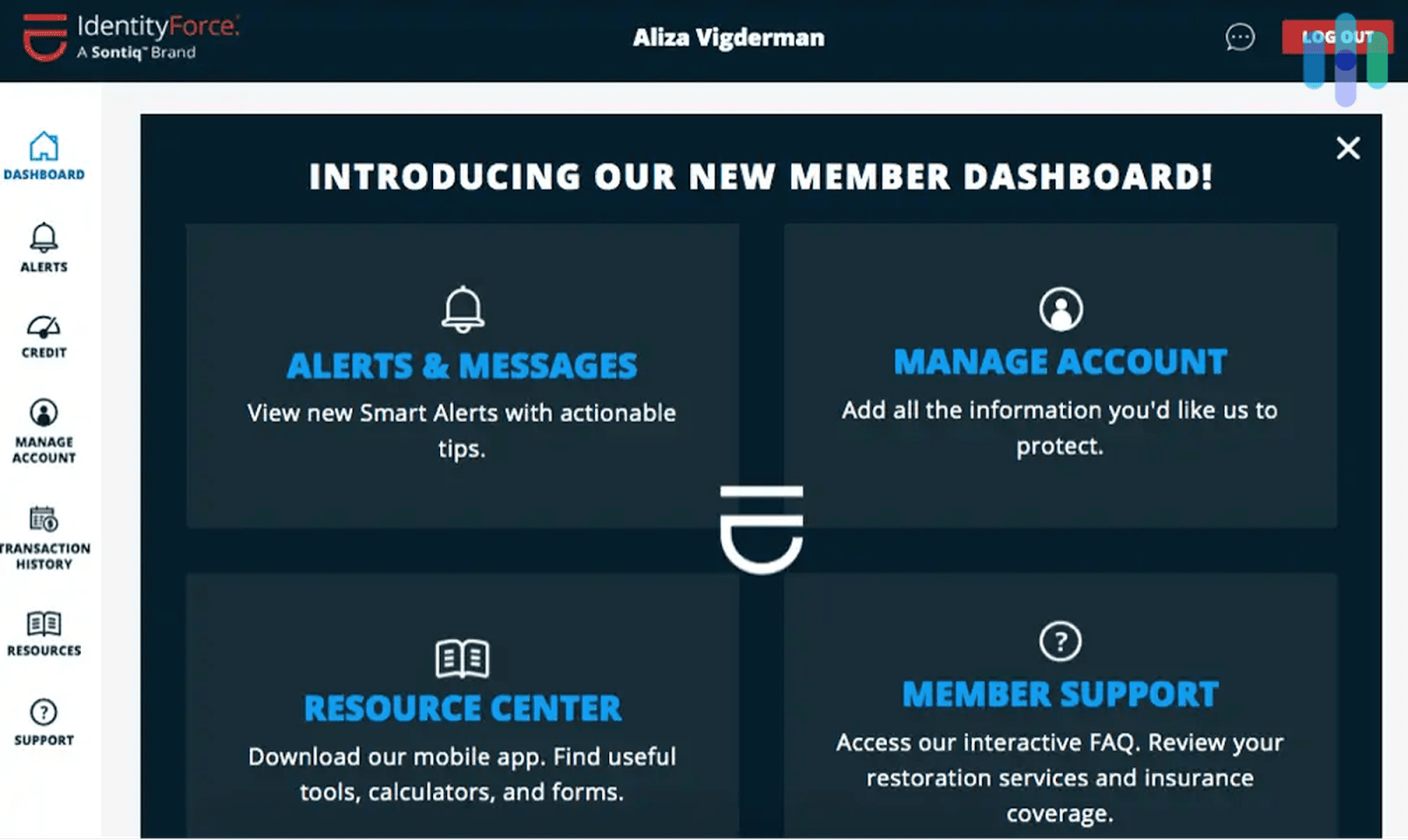

#1. IdentityForce: Best for comprehensive identity theft protection

- 💵 Monthly Fee: $19.90-$39.90

- 🛡️ Key Features: Credit score tracking, Identity theft protection, Recovery services, and Credit monitoring

- 🏦 Credit Bureau: Experian, Equifax, and TransUnion

- 🆓 Free Trial: Yes, 30 days.

IdentityForce goes beyond basic credit monitoring. It provides a holistic approach to identity protection.

IdentityForce goes beyond basic credit monitoring. It provides a holistic approach to identity protection. IdentityForce offers excellent value to maintain your credit health. This service is perfect for everyone. Especially families who need premium credit monitoring services at a low cost.

Pros

- Comprehensive protection

- Affordable plans

- 24/7 customer support

Cons

- Some advanced features might come with extra costs

Source: IdentityForce

#2. PrivacyGuard: Best for detailed credit reports and alerts

- 💵 Monthly Fee: $9.99 -$24.99

- 🛡️ Key Features: Credit reports, 24/7 Credit monitoring, and Credit score simulator

- 🏦 Credit Bureau: Equifax, TransUnion, and Experian

- 🆓 Free Trial: Yes, 14 days.

PrivacyGuard focuses on extensive credit monitoring services. They offer this at a price point that makes sense for low-income families. PrivacyGuard is particularly beneficial if you want to do any of the following tasks:

- Improve your credit score

- Plan a major purchase

- Safeguard your identity

Pros

- Affordable pricing

- Real-time alerts

- Comprehensive monitoring

Cons

- Limited free trial

- No family plan

Source: PrivacyGuard

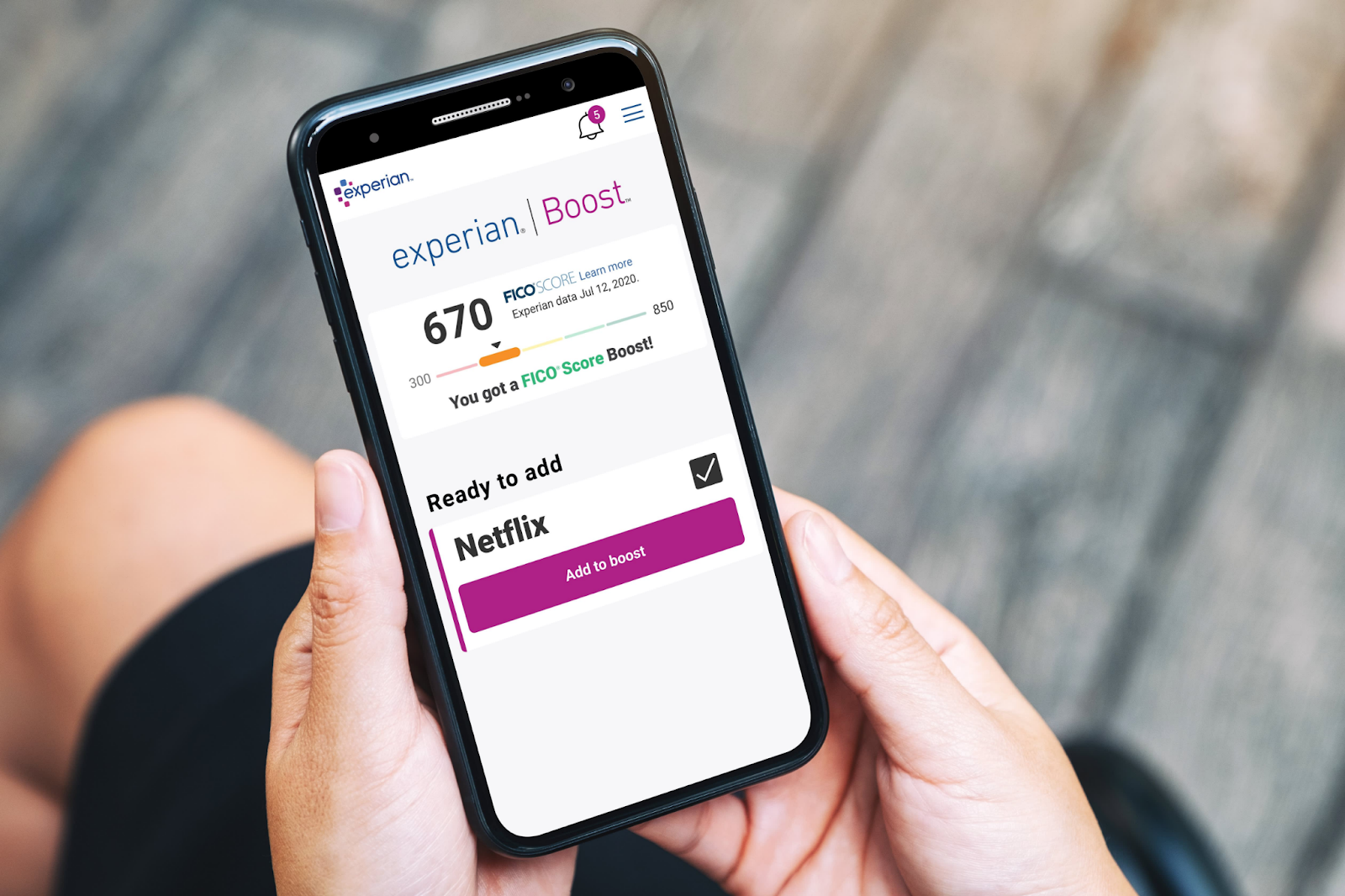

#3. Experian IdentityWorks: Best for comprehensive identity and credit monitoring

- 💵 Monthly Fee: $19.99 -$29.99

- 🛡️ Key Features: Credit lock, Dark web surveillance, and Multi-bureau credit monitoring

- 🏦 Credit Bureau: Experian, Equifax, and TransUnion

- 🆓 Free Trial: Yes, 7 days.

Experian IdentityWorks also offers continuous credit monitoring and identity protection. This means you can catch potential issues early to save you the stress.

The premium plans keep an eye on Equifax and TransUnion as well as Experian credit bureau. Moreover, it scans your personal information on illegal sites. This helps you prevent identity theft before it occurs.

Pros

- Comprehensive multi-bureau credit monitoring

- Extensive identity theft protection (includes dark web surveillance)

- Identity theft insurance up to $1 million

Cons

- Full multi-bureau monitoring only available with premium plans

- Limited features such as credit lock

Source: Experian IdentityWorks

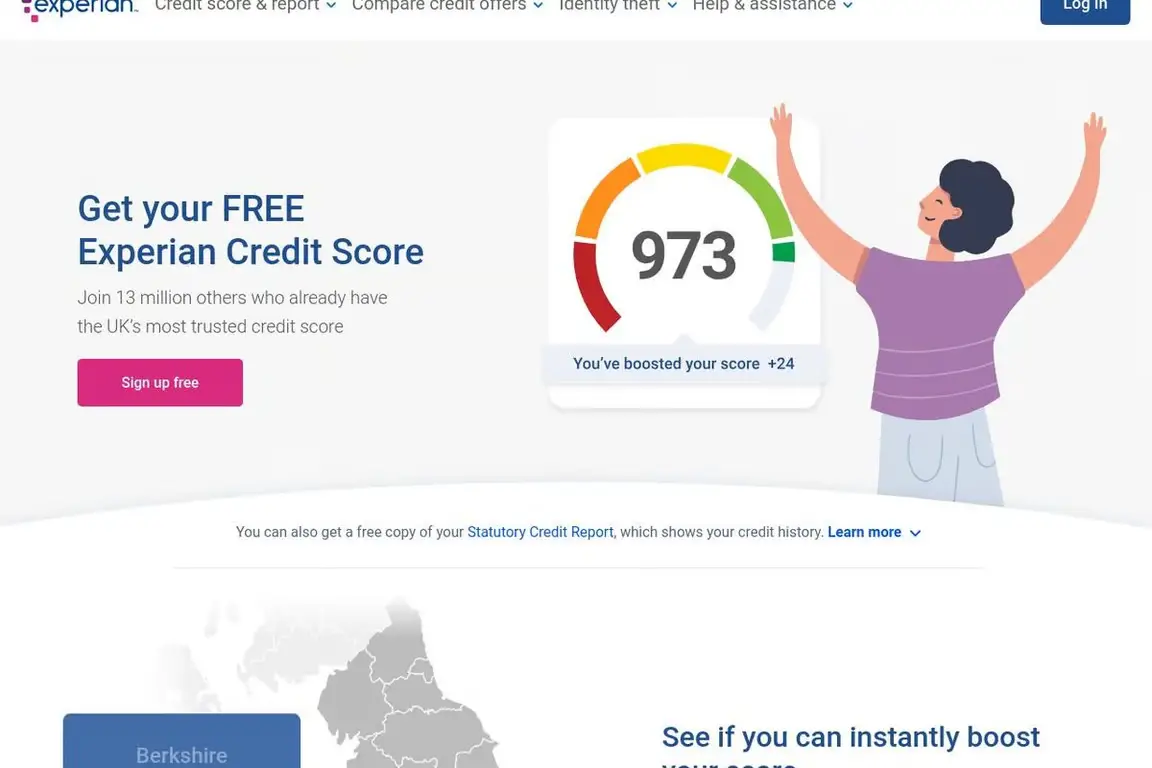

#4. Experian: Best for monitoring Experian credit scores

- 💵 Monthly Fee: Free

- 🛡️ Key Features: Free credit monitoring

- 🏦 Credit Bureau: Experian

- 🆓 Free Trial: Yes, it’s free.

This is another reliable credit monitoring service for managing your finances. Especially if you are new to credit monitoring. With this tool, you will gain access to your Experian credit report and FICO score. This is a great starting point for understanding your credit standing.

Pros

- Free access

- Comprehensive alerts

Cons

- Single bureau monitoring

- Limited features

Source: Experian

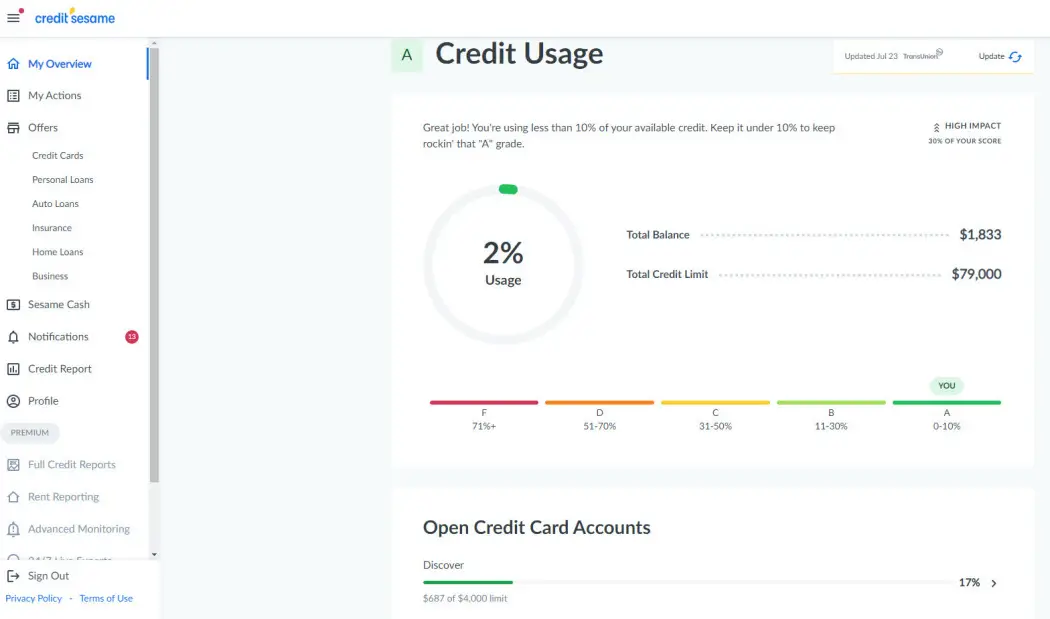

#5. Credit Sesame: Best for free credit score and monitoring

- 💵 Monthly Fee: Free (but premium plans costs $9.99)

- 🛡️ Key Features: Free credit score, credit report card, and identity theft insurance

- 🏦 Credit Bureau: TransUnion

- 🆓 Free Trial: Free

Credit Sesame is another excellent free credit monitoring service. Its uniqueness lies in its comprehensive free plan. This includes many features only available in paid services.

The accessibility ensures you stay on top of your credit at no extra cost. Credit Sesame provides monthly insights that may help you identify areas for improvement.

Pros

- No cost for essential credit monitoring services

- Regular updates

- Identity theft insurance up to $50,000

Cons

- Single bureau monitoring

- Limited advanced features

Source: Credit Sesame

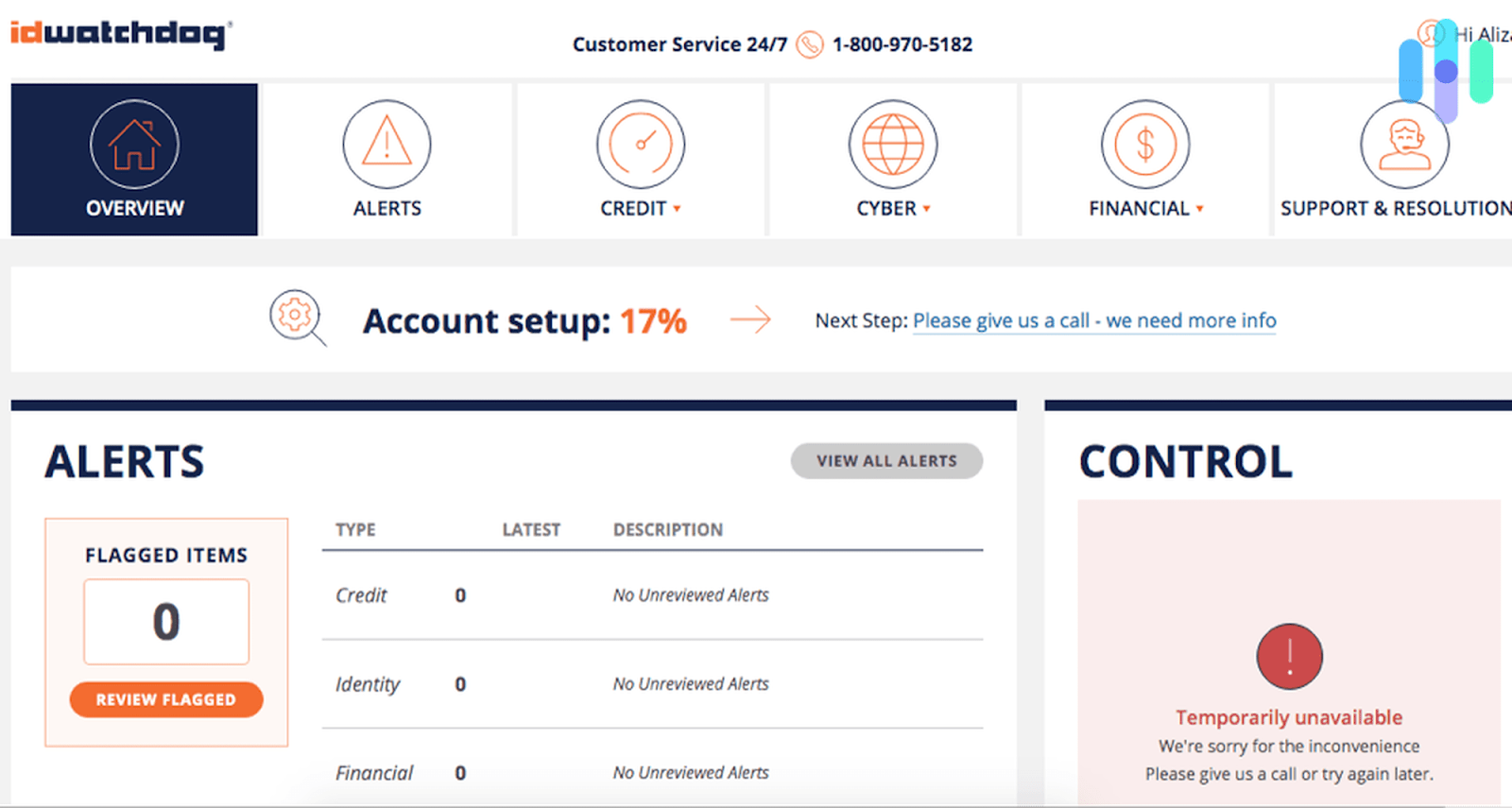

#6. ID Watchdog: Best for personalized identity theft protection

- 💵 Monthly Fee: $14.95 -$34.95

- 🛡️ Key Features: Child identity monitoring and Identity resolution.

- 🏦 Credit Bureau: Experian, Equifax, and TransUnion

- 🆓 Free Trial: Yes, 14 days.

ID Watchdog might be for you. This is if you are searching for a balance between protection and affordability. It gives you access to essential tools to manage your credit. This helps you maintain a healthy credit profile without incurring high costs.

ID Watchdog is also committed to offering 100% resolution of identity theft issues. That is. If someone has compromised your identity, they work to restore it to its original state. That’s not all. This platform also protects your children’s personal information from an early age.

Pros

- Affordable plans

- Manage your credit reports, social media, public records, and more.

- Full-service resolution in case of identity theft

- Protect your children’s personal information

Cons

- ID Watchdog offers fewer free features than some competitors

Source: ID Watchdog

#7. IDShield: Best for 24/7 identity theft monitoring and full restoration plans

- 💵 Monthly Fee: $14.95-$34.95

- 🛡️ Key Features: Comprehensive identity monitoring, Credit monitoring, and Licensed private investigators

- 🏦 Credit Bureau: Equifax, TransUnion, and Experian

- 🆓 Free Trial: Yes, 30 days.

Sometimes, managing your credit and protecting your identity can feel overwhelming. Especially when you’re on a tight budget.

IDShield monitors your credit and personal information. This way, they alert you to any potential issues before they become major problems.

Most of the services available focus on credit scores. But IDShield provides a holistic approach to protecting your personal and financial information. It includes dark web surveillance and social media monitoring. IDShield even provides licensed private investigators to help resolve identity theft issues.

Pros

- Expert help

- Affordable pricing

- Family plans available

Cons

- Requires extra fees for some features

Source: IDShield

#8. CreditWise: Best for free TransUnion credit monitoring

- 💵 Monthly Fee: Free

- 🛡️ Key Features: Dark web monitoring, Free access, and Credit simulator.

- 🏦 Credit Bureau: TransUnion

- 🆓 Free Trial: Free

Here is another service that is available to everyone, not just Capital One customers. You can take advantage of its credit monitoring tools without a Capital One account. This inclusive approach ensures that you can access your credit information.

So, CreditWise can be the perfect solution for you. Particularly, if you want to make sure there are no errors on your report.

Pros

- No cost to access or use

- Credit simulator helps you make informed decisions

- The timely alerts keep you aware of important changes

Cons

- Limited to one bureau

- Doesn’t provide a FICO score. This might inconvenience you as some lenders don’t use VantageScore.

Source: CreditWise

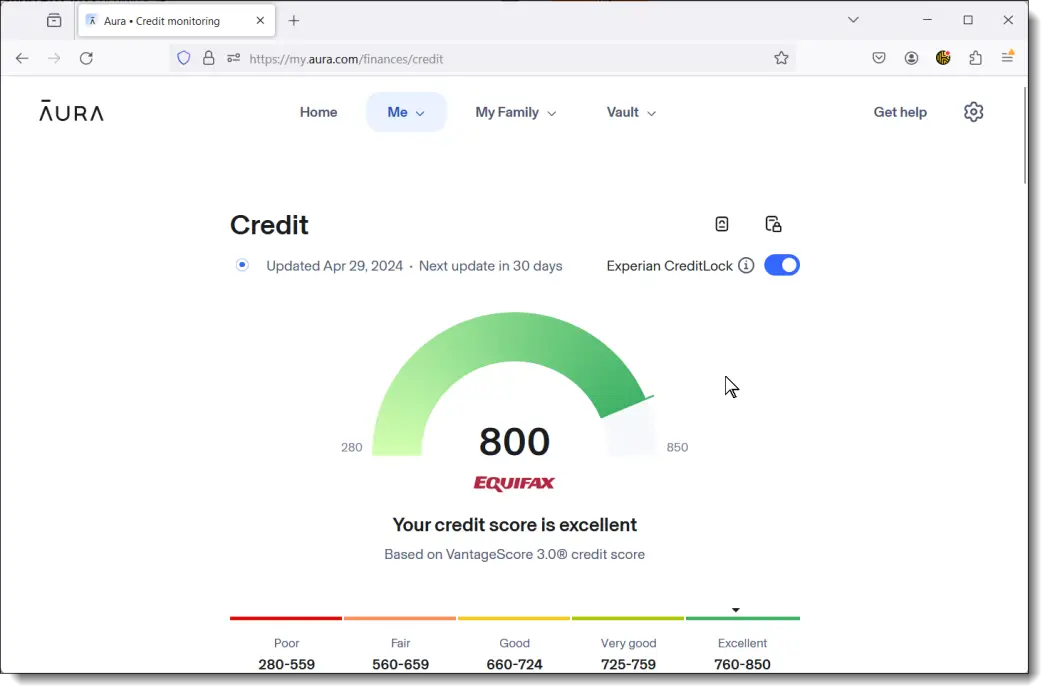

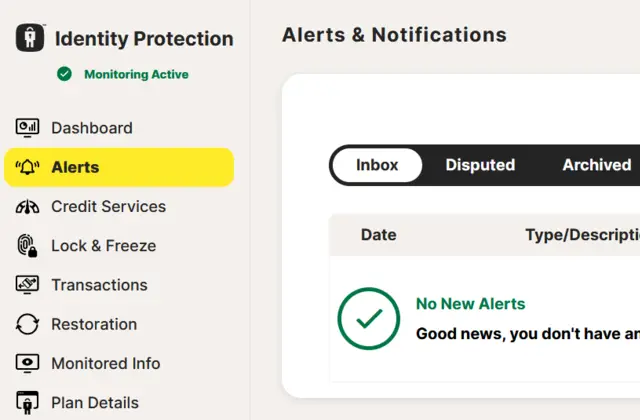

#9. Aura: Best for all-in-one digital security and identity protection

- 💵 Monthly Fee: $11.99

- 🛡️ Key Features: $1 million insurance, Financial fraud alerts, and Identity theft protection

- 🏦 Credit Bureau: Equifax, TransUnion, and Experian

- 🆓 Free Trial: Yes, 14 days

Aura offers more than basic credit monitoring. It provides an all-in-one digital security solution that includes:

- Identity theft protection

- Financial fraud alerts

- Online privacy tools

This holistic approach ensures your financial information is safe from various threats. Many users prefer Aura for its combination of services. This is a complete security package that helps safeguard your entire digital presence. Aura is an option if you want a way to protect yourself without juggling many services.

Pros

- Family-friendly plans are available

- Up to $1 million in identity theft insurance

- Comprehensive protection

Cons

- It’s complex, especially if you need a simple credit monitoring service

- Even at $11.99, this service may still be pricey for low-income families

Source: Aura

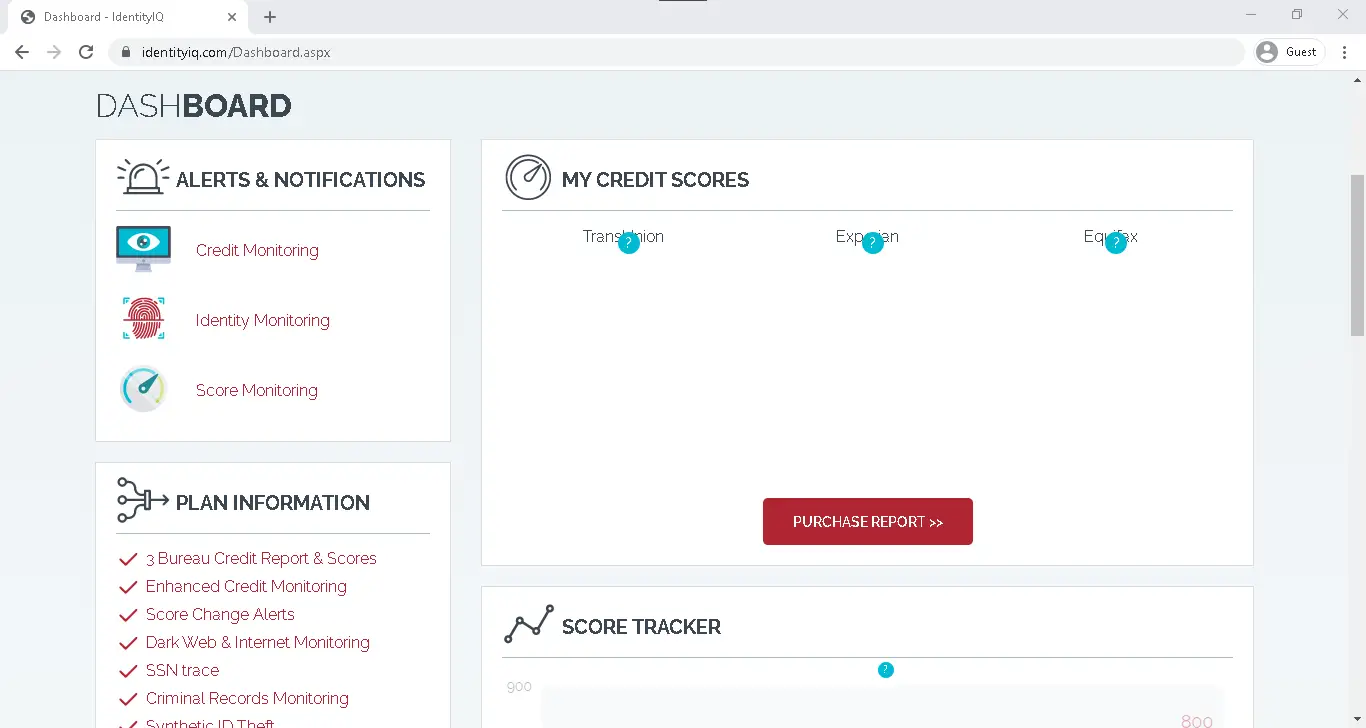

#10. IdentityIQ: Best for monitoring all three credit bureaus

- 💵 Monthly Fee: $6.99 -$9.99

- 🛡️ Key Features: Credit score tracking, Family protection plans, and Comprehensive credit monitoring

- 🏦 Credit Bureau: TransUnion, Experian, and Equifax

- 🆓 Free Trial: No

IdentityIQ is one of the services that will help you stay on top of your credit situation. It delivers thorough credit monitoring and identity theft protection. These two services ensure you have the tools to safeguard your financial future.

IdentityIQ is ideal for:

- Individuals and families on a budget but want comprehensive credit and identity protection.

- Anyone who wants to stay informed about their credit status.

- Those who want a service that offers more than credit monitoring.

Pros

- Offers pricing plans that fit different budgets. This makes it accessible to low-income families.

- Provides a combination of credit monitoring and identity theft protection

Cons

- Some of the more advanced features are only available in higher-tier plans.

- You can’t test this service because they don’t have a free trial.

Source: IdentityIQ

#11. LifeLock: Best for extensive identity theft protection and recovery

- 💵 Monthly Fee: $11.99 -$35.99

- 🛡️ Key Features: Comprehensive identity theft protection, Credit monitoring, Identity theft insurance

- 🏦 Credit Bureau: Experian, Equifax, and TransUnion

- 🆓 Free Trial: Yes, 30 days.

LifeLock is a credit monitoring service that also monitors your credit. It also protects your identity. This alerts you to any suspicious activities that could harm your credit score.

Their approach is proactive. They protect your information before any damage occurs. This includes:

- Dark web surveillance

- Identity restoration support

- Insurance that covers both personal expenses and legal fees resulting from identity theft

Pros

- Extensive monitoring

- Identity theft insurance

- Family plans that protect family members

Cons

- The might be a concern for very tight budgets

- Some plans may not include full access to your credit score

Source: LifeLock

#12. Identity Guard: Best for AI-driven identity theft protection

- 💵 Monthly Fee: $6.67 -$31.99

- 🛡️ Key Features: IBM Watson AI Technology, Dark Web Monitoring, and Credit Score Monitoring

- 🏦 Credit Bureau: TransUnion, Experian, and Equifax

- 🆓 Free Trial: No

Identity Guard utilizes IBM Watson to offer proactive monitoring and alerts. This AI technology helps detect threats better than traditional monitoring methods.

The service goes beyond credit monitoring. It includes:

- Dark web monitoring

- Risk management reports

- Social media insights

If you want to maintain a healthy credit score, Identity Guard is a great choice.

Pros

- The IBM Watson ensures top-notch threat detection and personalized alerts

- The extensive monitoring includes dark web and social media

Cons

- The most affordable plan may lack some advanced features found in higher-tier plans

- It doesn’t offer a free trial period

- Some users report that customer support can be slow to respond at times

Source: Identity Guard

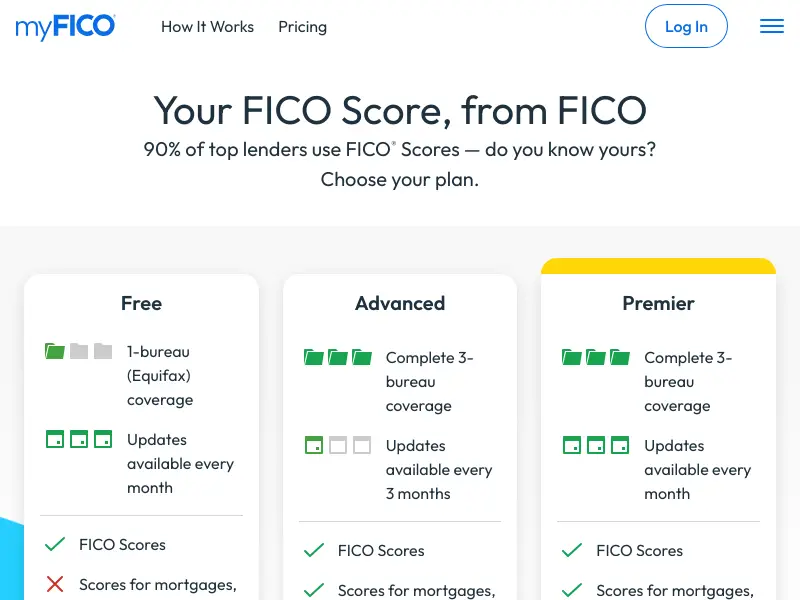

#13. myFICO: Best for FICO score monitoring and detailed credit reports

- 💵 Monthly Fee: $19.95

- 🛡️ Key Features: FICO® Score Updates, Identity theft protection, and Credit score simulator

- 🏦 Credit Bureau: Equifax, Experian, and TransUnion

- 🆓 Free Trial: Yes, 30 days.

myFICO offers a credit monitoring service that stands out for its depth. It gives you a detailed and clear picture of your credit status.

The service distinguishes itself by providing FICO® Scores. These are the scores most used by lenders. Other credit monitoring services might provide less relevant scores.

So, myFICO gives you the scores lenders use to make decisions about creditworthiness. This means you get a more accurate representation of where you stand.

Pros

- Provides FICO® Scores

- Offers educational resources

- The comprehensive monitoring gives you a complete view of your credit

Cons

- May be too complex for new users

- More expensive compared to others on this list

Source: myFICO

8 Tips to Help You Choose the Best Credit Monitoring Service

The tips below will help you choose the best credit monitoring service.

#1. Look for Identity Theft Protection

This feature monitors various databases. Then, alerts you if someone uses your personal information in suspicious activities. If it detects any unusual activity, you receive immediate notifications. This allows you to act and mitigate potential damage.

Some services even offer recovery solutions to help you restore your identity. Moreover, credit monitoring services with identity theft protection often include insurance coverage. This helps cover the costs associated with identity restoration.

#2. Compare Prices

You should balance the cost with the level of protection and features you actually need. Some credit monitoring services offer basic features for free. This might be enough if you’re only concerned about receiving alerts.

Other services might charge a monthly fee but offer extra benefits like:

- Identity theft insurance

- More frequent credit report updates

- Access to credit scores.

Price comparison helps you avoid overpaying for features that might not be necessary for your situation. Some premium services offer daily credit report updates and extensive identity theft protection. While this may be valuable, not everyone needs such comprehensive coverage.

#3. Read Reviews

Reviews usually highlight both the strengths and weaknesses of a service. You might discover common issues that users face. These are things that might not be clear from the company’s marketing materials. You can also identify services that receive praise for their features.

#4. Check Coverage

First, consider which credit bureaus the service monitors. There are three main credit bureaus in the United States:

- Equifax

- Experian

- TransUnion.

A comprehensive credit monitoring service will track your credit activity across all three. This ensures you get a complete picture of your credit health. Each bureau may have different information on your credit history.

Next, think about the types of alerts you will receive. The best services offer real-time alerts for various suspicious activities. Timely alerts allow you to take immediate action. This may prevent potential damage to your credit.

#5. Look at Features

These are the specific tools and benefits provided by the service, such as:

- Credit score tracking

- Alerts for changes in your credit report

- Identity theft insurance

- Access to financial education resources.

The specific features offered by different services can vary widely. Some might provide basic monitoring and alerts. Others offer more comprehensive services.

So, you should evaluate the features most relevant to your needs. Look for services that offer detailed analysis on how to boost your credit if you want to improve it. But one with robust identity theft protection is enough if you want to protect your identity.

#6. Check for Free Trials

This offers a risk-free way to evaluate a service’s worth and decide if it’s a justifiable expense. During a free trial, you can assess the following:

- User interface

- Ease of navigation

- Premium credit monitoring features.

You’ll be able to see how timely and accurate the alerts are for any changes in your credit report. This can help you determine if the service provides the level of monitoring you’re seeking.

#7. Customer Service

This is the support that helps you feel more confident in your financial decisions. Good customer service means having access to knowledgeable representatives. They can help you:

- Understand your credit reports

- Address any issues

- Provide guidance on how to improve your credit score.

Look for services that offer multiple channels of support, such as:

- Phone

- Live chat

Simply, ensure they have extended hours or even 24/7 availability. This way, you’ll get help whenever you need it.

#8. Mobile Access

This access means you have all the tools you need right at your fingertips. Many apps provide additional features such as:

- Credit score simulators

- Personalized tips for improving your credit

- Easy-to-understand summaries of your credit report.

These tools can empower you to:

- Make informed financial decisions

- Manage your credit score

- Improve your financial health.

Therefore, mobile access is an essential factor when selecting a credit monitoring service. This way, it ensures you are always informed and can act quickly to protect and improve your credit score.

Free Vs Paid: Which One is the Best for You?

Deciding which one to choose is a significant choice, especially for low-income families. You have to understand what each option offers. This will help you make an informed decision that aligns with your needs.

What Free Credit Monitoring Services Offer

Free credit monitoring services provide basic features at no cost. These services mostly include:

#1. Credit Report Access

Most free services offer access to your credit reports from one or more of the major credit bureaus. This allows you to keep an eye on your credit history and identify any discrepancies.

#2. Alerts for Changes

Free services often provide alerts for significant changes in your credit report.

#3. Basic Identity Theft Protection

Some free services include basic identity theft protection features. This may just be alerts for suspicious activity.

#4. Educational Resources

Many free credit monitoring services offer educational resources. These help you understand credit reports and scores.

While free services can be quite useful, they often have limitations. For example, they might not provide real-time alerts. However, these services can be a valuable resource if you just want to keep track of your credit.

What Paid Credit Monitoring Services Offer

Paid credit monitoring services come with a subscription. They also offer a more comprehensive suite of features. Here’s what you can expect from a paid service:

#1. Comprehensive Credit Reports and Scores

Paid services usually provide detailed credit reports from all three major credit bureaus. These are updated more frequently than free services.

#2. Real-Time Alerts

You can receive real-time alerts for any changes to help you react to potential fraud.

#3. Strong Identity Theft Protection

Paid services often include extensive identity theft protection measures, such as:

- Identity theft insurance

- Assistance with identity recovery

- Dark web monitoring.

#4. Credit Score Tracking and Analysis

These services provide tools to track your credit score over time. They also analyze factors affecting your score. This offers personalized tips to improve your credit health.

#5. Customer Support

Paid services generally offer robust customer support. This includes access to credit specialists. These people can help you understand your credit report.

So, the cost of paid credit monitoring services might be a concern. However, the additional features and peace of mind they offer can be worth the investment. Especially if you are dealing with complex credit issues.

Making the Choice: Free or Paid?

You consider your specific needs to decide between the two. If you just want basic monitoring, a free service might be enough. It allows you to keep an eye on your credit without any extra costs.

If you need comprehensive protection, a paid service may be a better choice. Especially if you can afford a small monthly fee. The features provide detailed insights into your credit health.

Conclusion

We’ve reached the conclusion and it’s clear you have several great options to consider. Each service offers unique benefits. So, selecting the right one depends on your specific needs and budget.