The best personal loans for low income families will depend on your needs. We reviewed your options so you can find the ideal loan for you.

Finding a personal loan that works for you can be hard, especially if you don’t have a lot of money. Sometimes, the interest rates are too high, or the rules to get the loan are too strict, and there might be hidden fees that make it even tougher.

For many families, unexpected costs or emergencies can cause a lot of stress. If you can’t get an affordable loan, it can make things even worse, leaving you worried about how to pay for everything.

There are personal loans made just for families with lower incomes. These loans have lower interest rates, flexible payment plans, and easier rules to qualify.

In this blog post, we’ll help you find the best personal loans for low-income families, so you can get the financial help you need without making things harder for yourself.

Table of Contents

What Are Low-Income Personal Loans?

Personal loans for people with low incomes are loans that you can get even if you don’t make a lot of money each month or year. Different lenders may have different rules, so you might still need to show that you have some income and good credit. Having a low income won’t stop you from getting the loan.

You can use a personal loan for many things, like fixing up your house, paying for medical bills, or combining all your high-interest debts into one. When you get a personal loan, you receive all the money at once and then pay it back over time, usually with a set interest rate.

If you apply for a personal loan and you have bad credit and low income, you might get a higher interest rate. Most lenders won’t charge more than 36% interest, but some might have even higher rates.

Before you accept any personal loan, especially if it’s for people with low incomes, make sure you understand all the terms and costs. This way, you’ll know exactly what you’re agreeing to.

You might also like:

- Unleash the Power of Payday Loans For Self Employed Individuals

- Payday Loans Online Texas: Everything You Need to Understand

- 50 Loan Instant No Credit Check App: Apps, Payday Loans, and No Credit Check Options

10 Best Personal Loans For Low Income Families

When you have less money to spend, getting the right loan can be harder. But don’t worry, some lenders are here to help people with lower incomes. In this section, we’ll show you how to find the best ones for your budget.

1. Upgrade

You can get one of the best personal loans from Upgrade, even if you have a low income. They support many different credit scores and incomes. You only need a minimum credit score of 560 to apply. This makes Upgrade a great option to build your credit, even if your income is low.

But be careful, because the interest rates can be very high if your credit score isn’t good. When you apply with Upgrade, they only do a soft credit check, so it won’t hurt your credit score.

If you’re having trouble making your monthly payments, you can ask Upgrade to lower your payments for a little while or change your loan so it’s easier to pay.

But if you have a really good credit score, Upgrade might not be the best choice. Other lenders might give you lower interest rates, higher loan amounts, and fewer fees.

Pros

- You can pay creditors directly for debt consolidation.

- You get a 1% discount if you set up automatic payments.

- There is no penalty if you pay off your loan early.

- You don’t need to have a minimum income requirement to apply.

- The minimum credit score requirement is reasonable.

Cons

- The loan limit is $50,000.

- The interest rate can go up to 35.47%.

2. LendingClub

You can get personal loans from LendingClub, a fully online bank, which makes it easy for you to borrow money. If you have a credit score of at least 600, you can qualify for a loan, and there is no need for a minimum income.

LendingClub is perfect for those who need small loans, offering amounts from $1,000 to $40,000. If you apply with co-low income borrowers, you can get even more money and better rates.

When you borrow money from LendingClub, you’ll notice there’s a fee called an origination fee. This fee is between 3% and 6% of the amount you borrow, which means it can be quite a bit of money. This fee is added to your loan amount, so you end up paying it back along with your loan.

It’s important to know that LendingClub might not be the best choice for everyone. If you have really good credit, you might find better rates with other lenders. It’s always a good idea to shop around and compare different options before deciding where to borrow money from.

Pros

- You only need a moderate credit score of 600.

- You can apply for joint loans.

- There are no limits on your debt-to-income ratio.

- You don’t need a minimum gross income.

- They do soft credit checks, which don’t hurt your credit score much.

Cons

- The APR (Annual Percentage Rate) can be high.

- There are relatively high origination fees.

3. Ally

You can get a personal loan from Ally Lending, the lending part of Ally Financial. They offer loans through some places like hospitals, home stores, car shops, and stores.

Sometimes, these places can give you a loan without any extra fees, which is great if you have a good credit score. But remember, Ally Lending doesn’t give loans in all states.

Pros

- You don’t have to pay any fees when you apply.

- Checking if you can get a loan won’t hurt your credit.

- If you pay your loan early, they won’t charge you extra.

- Some places offer loans without any interest.

- You can set up your account and handle your loans online.

Cons

- You can’t apply for a loan straight from Ally Lending; you have to go through another company.

- They don’t tell you upfront about how long you have to pay back the loan or what credit score you need.

4. Universal Credit

Universal Credit is an online lender that doesn’t require a minimum income, as per their customer support. If you qualify, you can borrow up to $50,000 and pay it back over as long as 60 months. Their loans are available in all 50 U.S. states, but not in Washington, D.C.

Even though Universal Credit has some good things, it also has some not-so-good things. Compared to other lenders, its APR range is high, and it charges origination fees of 5.25% to 9.99%, which can add up.

However, if you want to pay back your loan early, there are no penalties. Just keep in mind, that there are late fees of up to $10 if you’re not able to make a payment on time.

Pros

- You can find out if you qualify beforehand.

- You get approved and receive money quickly.

- You can get big loans if you qualify.

Cons

- You might have to pay fees to start the loan.

- The interest rates can be high.

5. Best Egg

Best Egg offers personal loans from $2,000 to $35,000 (and even up to $50,000 with a special offer), and they don’t ask how much you earn each year. They also have loans with lower interest rates if you have something valuable to use as security.

If you need only a little money, though, Best Egg might not be the best choice because their smallest loan is quite big. But if you have good credit, Best Egg could be a good option because they have competitive interest rates.

It’s important to know that their interest rates can go up to 35.99%, which is a lot. They also charge an origination fee, which is a fee for starting the loan, of up to 8.99%. But here’s the good part: they don’t charge extra if you pay back your loan early or if you miss a payment.

Plus, if you borrow from Best Egg, you can check your credit score for free. This can help you understand how good you are at borrowing money!

Pros

- You don’t need to earn much money each year to apply for a loan.

- You can borrow a lot of money if you need it.

- You can check your credit score for free.

Cons

- You have to borrow a lot of money at once.

- The interest rate can be very high.

6. Upstart

If you make more than $12,000 a year, Upstart has a great loan offer for you! You can get a loan for as little as $1,000 or as much as $50,000, and you can use it for lots of things like paying off debt, fixing up your home, paying medical bills, moving, and more.

Upstart also offers competitive rates to help you save money! If you’re looking for a loan, Upstart might be a good option for you! Unlike some lenders that need good credit, Upstart is happy to help even if your credit score is 300 or more.

You just need to meet their rules. They also work with people who have limited credit history. To get a loan with Upstart, you need to be at least 18 years old, have a real bank account, and have proof of income, a job, and a U.S. home address.

But keep in mind that upstart loans have some fees. They might charge up to 12% of the loan amount as an origination fee. And if you pay late, they could charge you 5% of the payment or $15, whichever is more.

Pros

- You don’t need to earn a lot of money each year.

- They consider things other than just your credit score when deciding to give you a loan.

- The smallest interest rate is quite low.

- You won’t be charged extra for paying off your loan early.

Cons

- You have to pay back the loan in a short amount of time.

- You’ll need to pay a fee when you start your loan.

7. Avant

If you need money, Avant can help! Avant is a website where you can borrow money. You can borrow from $2,000 to $35,000. You can pay the money back over five years. Avant gives you the money quickly. You can get the money as soon as the next day after you apply and get approved.

You don’t need to earn a lot of money or have perfect credit to borrow from Avant. You don’t need to make a certain amount of money each year. You just need a credit score of at least 580.

Avant’s interest rates can be higher than in other places. They also charge a fee of up to 4.75% of the total amount you borrow. Even with these things, Avant’s loans can still be a good choice for people who need money fast and don’t earn a lot.

Pros

- You don’t need to earn a certain amount of money every year.

- Your credit score can be pretty low, and you can still get the loan.

- You can choose how long you want to take to pay back the loan.

- You can get the money quickly!

Cons

- You can’t borrow a ton of money.

- There are some extra fees you have to pay.

- The interest rates can be a bit high.

8. Achieve

Achieve is a company that used to be called Freedom Plus. They help people like you get personal loans. You can borrow up to $50,000, or even $100,000 if you’re good with money.

Now, you might wonder if you can get a loan with them if your credit score isn’t perfect. Well, the good news is, you only need a score of 620 to be considered. That means if your credit is okay, you still have a chance!

Achieve might be great for you if you need a big loan. They say you should make at least 2.5 times the amount of money you want to borrow each month to qualify. Oh, and you have to meet some other rules too, but don’t worry, it’s not too tricky.

If your credit is really good, you might get a low rate with Achieve. But if it’s just okay, your rate might be higher. And watch out for those origination fees – they can be up to 6.99%! Achieve won’t charge you extra if you pay back your loan early, or if you’re a bit late with a payment.

Pros

- You can get a lot of money if you need it.

- Sometimes, you might get a discount on the interest rate.

- You could get your money in just one to three days!

Cons

- You might need to borrow more money than you want.

- The highest interest rate they charge is pretty high.

- They might ask you to pay a fee when you get the loan.

9. Prosper

Prosper is a special place where you can borrow money from other people. It’s like asking a friend for help but through a safe website. You can borrow different amounts, starting from $2,000 up to $50,000. You can check how much you might borrow without hurting your credit score!

If you decide to borrow money from Prosper, you can get it fast! In just three days, you could have the money you need in your hands.

But remember, borrowing money means you have to pay it back. Prosper gives you time to pay back the money, from 24 months up to 60 months. They also charge a fee when you borrow the money, but they don’t charge you extra if you want to pay back the money early.

Prosper wants to help people, so they try to make borrowing money easy and fair. If you ever need help, it’s good to know there are places like Prosper that can lend a hand!

Pros

- You can borrow different amounts of money

- You need a good credit score

- You can get money in just three days

Cons

- You have to pay extra fees at the beginning and if you’re late

- The loan lasts from 1% to 7.99%

- The highest interest rate is very high

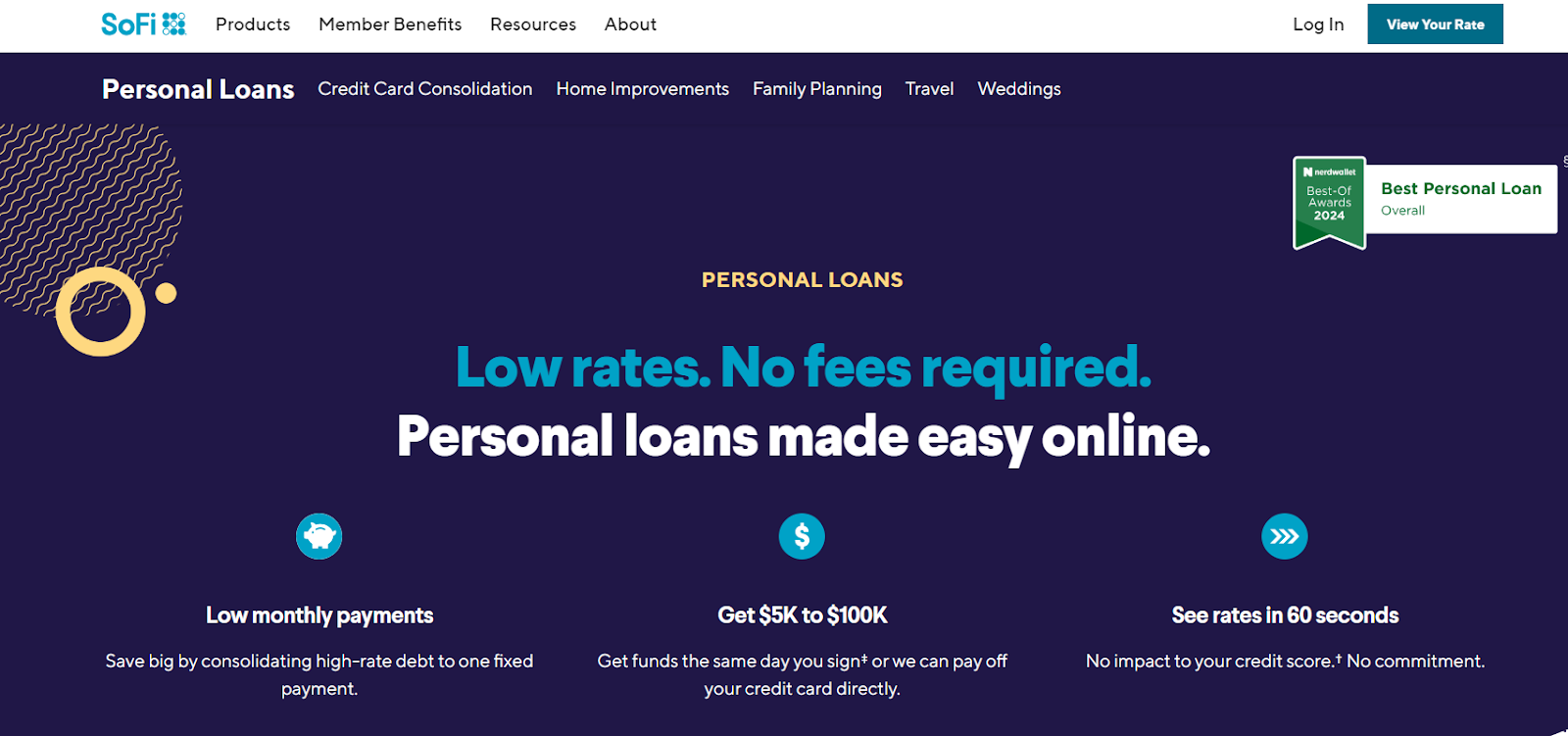

10. SoFi

SoFi is a special place online where you can borrow money if you need it. SoFi started helping people in 2011 and has given out more than $50 billion in loans since then. What makes SoFi different is that they offer big low income loan without needing to give anything valuable as security.

At SoFi, you can borrow from $5,000 to $100,000. This is great for people with really good credit scores who need a lot of money. The amount you can borrow might change depending on where you live. You can take your time to pay back the money, anywhere from two to seven years.

SoFi is nice like that, giving you plenty of time to pay if you have a good credit score (at least 650) and make enough money each year (at least $45,000). If you want, you can apply for a loan with someone else, like a family member or friend, but you can’t have someone else pay your loan for you.

Pros

- You can check if you qualify without affecting your credit score.

- You might get approved on the same day you apply.

- You can use the loan to pay off other people you owe money to.

Cons

- You need to have a high credit score.

- You can’t have someone else sign the loan with you.

Types of Low-Income Personal Loans

If you need to borrow money but don’t have a lot of money, you can consider different types of loans. Each type has its features, benefits, and things to watch out for. Here’s a guide to help you understand the most common types of loans and decide which one might be best for you:

Secured Loans

These loans require you to give something valuable, like your car or home, as a guarantee. The good thing is that they often have lower interest rates because of this guarantee. But, if you can’t pay back the loan, you might lose your valuable asset. These loans are best for people with valuable assets who are sure they can pay back the loan.

Unsecured Loans

These loans don’t need any collateral. Approval is based on your credit score and other factors. The good thing is that you don’t risk losing any personal assets. But, they might have higher interest rates. These loans are good for people without many assets or those who don’t want to risk their assets.

Payday Loans

These are short-term loans that you have to pay back by your next payday. The good thing is that you can get the money quickly when you need it. But, they usually have high interest rates and can lead to a cycle of debt if you’re not careful. Payday loans are best for emergencies, but you need to be careful because they can be expensive.

Installment Loans

These loans let you borrow a lump sum and pay it back in regular payments over time. The good thing is that you know exactly how much you need to pay each month, which makes budgeting easier. But, they might have higher interest rates. These loans are good for larger expenses that you want to pay back over a longer period.

Credit Builder Loans

These loans keep the borrowed money in a secure account until you pay it off. This can help improve your credit score. But, you can’t access the money right away. These loans are good for people who want to build or repair their credit.

You might also like:

- Allotment Loans For Federal Employees No Credit Check

- 10 Approaches to Secure a 200 dollar payday loans Instantly

- Unleash the Power of Payday Loans For Self Employed Individuals

How to Apply for a Personal Loan with Low Income?

To get a personal loan when you don’t earn much, you might need to work a little harder, but it’s possible. Follow these steps to improve your chances of getting a personal loan:

Check Your Credit Score

Look at your credit report to make sure it’s correct. A higher credit score can make it easier to get a loan. You can get a free credit report once a year from each of the major credit bureaus.

Improve Your Credit Score

If your credit score isn’t great, try to make it better. Pay off any debts you have, pay your bills on time, and fix any mistakes on your credit report.

Understand Your Budget

Know how much money you have and how much you can borrow and pay back comfortably. Lenders look at how much debt you have compared to how much money you make.

Research Different Lenders

Look at different lenders, like banks, credit unions, online lenders, and peer-to-peer lending platforms. Each one might have different rules and loan terms.

Think About Secured Loans

If your credit score worries you, look into secured loans. With these loans, you have to offer something valuable, like a car or savings account, as a guarantee. This can make it easier to get approved.

Get Your Documents Ready

Gather all the papers you need, like proof of income, work history, ID, and financial statements. Lenders need this info to decide if they’ll give you a loan.

Make a Strong Loan Application

Write a good application. Explain why you need the loan, how you’ll use the money, and how you’ll pay it back. A good application can make lenders more likely to say yes.

Consider a Co-Signer

If your income and credit score aren’t enough, ask a family member or friend with good credit to co-sign your loan. Their good credit can help you get approved.

Ask for a Small Loan

Try asking for a smaller loan that fits your income. Smaller loans are often easier to get and easier to pay back.

Be Careful With High-Interest Loans

Stay away from loans with very high interest rates, like payday loans. They can make you owe a lot of money. Look at other options first.

Compare Loan Offers

Look at different loan offers and compare things like interest rates, how you pay back the loan, fees, and how much you’ll borrow in total. Pick the loan that’s best for you.

Apply Online or In-Person

Fill out the loan application either online or in person, depending on what the lender wants. Follow their instructions and give them all the info they need quickly.

Check the Loan Terms

Before you agree to a loan, read all the terms and conditions. Make sure you understand the interest rate, when you have to pay back the loan, and any fees.

Pay Back Your Loan On Time

Once you get a loan, make sure to pay it back on time. This will help you build good credit and avoid more financial problems.

Remember, it might take time to get a personal loan when you don’t earn much. But by working hard to improve your finances and looking at all your options, you can get a loan that works for you.

Alternatives of Personal Loans for Low Income Families

Thinking about getting a personal loan but not sure if it’s the best move for you? Let’s explore some other options that might work better, especially if you don’t make a lot of money:

Budgeting and Saving

First things first, take a good look at your money. Is there anywhere you can spend less or save more? Making a plan for your money and putting some aside for emergencies can help you handle unexpected costs without borrowing.

Help from the Government

Depending on where you live and your situation, the government might have programs to help out with money, food, or housing. These programs are there to support people who don’t have a lot of money.

Nonprofit Groups

Some groups that aren’t in it for profit can help out with money, food, or other kinds of support if you’re having a tough time with money.

Doing Extra Work

If you have some free time, you could try doing extra jobs or side jobs to make more money. There are lots of ways to make extra cash, like doing tasks for people or driving people around.

Talking to the People You Owe Money To

If you already owe money, try talking to the people you owe. Sometimes they might be okay with changing how you pay them back, like making the payments smaller or easier to manage.

Getting Advice About Money

Some people are good at helping others with money stuff. They can give you tips on how to handle your money, pay off debts, and make your credit score better.

Help from Your Community

Sometimes local groups or churches can help out if you’re struggling. They might give out food, help pay bills, or do other things to lend a hand.

Borrowing from Regular People

There are websites where people can lend money to each other. Sometimes these sites are easier to work with than big banks.

Borrowing from Friends or Family

If you can, you might ask someone you know for a loan. But make sure you both agree on when and how you’ll pay it back, so there are no hard feelings later.

Using a Credit Card Wisely

Credit cards can be handy for paying for things quickly, but they can also get you into trouble if you’re not careful. It’s best to only use them for small stuff you can pay off right away.

Conclusion

If you ever need extra money, you might think about getting a personal loan. But if you don’t earn a lot, it can be hard to handle. Some lenders have loans that are easier to pay for if you don’t earn much.

Before you decide, check if you can pay the money back every month. Look at safe options like personal loans and credit cards first. Only try riskier loans with high interest rates if you need to. If you like this advice, tell your friends about it too!

You might also like:

- Payday loans credit score 400 guaranteed and no telecheck

- 1 Hour Payday Loans No Credit Check from Direct Lenders

- How to choose High risk personal loans guaranteed approval direct lenders

FAQs

How can I get a personal loan with bad credit?

If you need money and have bad credit, you can ask someone to help you apply for a loan, or you can find a loan that is secured with something valuable, like your toys. You can also try borrowing money from a credit union, which is a place that helps people with money.

Are there government programs that offer low-income personal loans?

If you need help with money, you can check out some government programs or assistance. They can give you money, but they’re not like regular low income loans. Look into local or national programs to see what might help you.

Can I use a low-income personal loan to consolidate debt?

You can use low-income personal loans to put all your debts together. When you combine many debts that have high interest rates into just one loan with a lower interest rate, it can make paying back the money easier for you.