Are you finding it hard to manage your money? Here are the best personal finance apps for low income families.

Personal finance apps help you budget, save, and track expenses all in one place. Basically, these apps simplify your money management.

Our article explores the top personal finance apps. You’ll learn about their features, benefits, and how they can help you achieve your financial stability.

Table of Contents

Best Personal Finance Apps

Read on to find the best app for your situation.

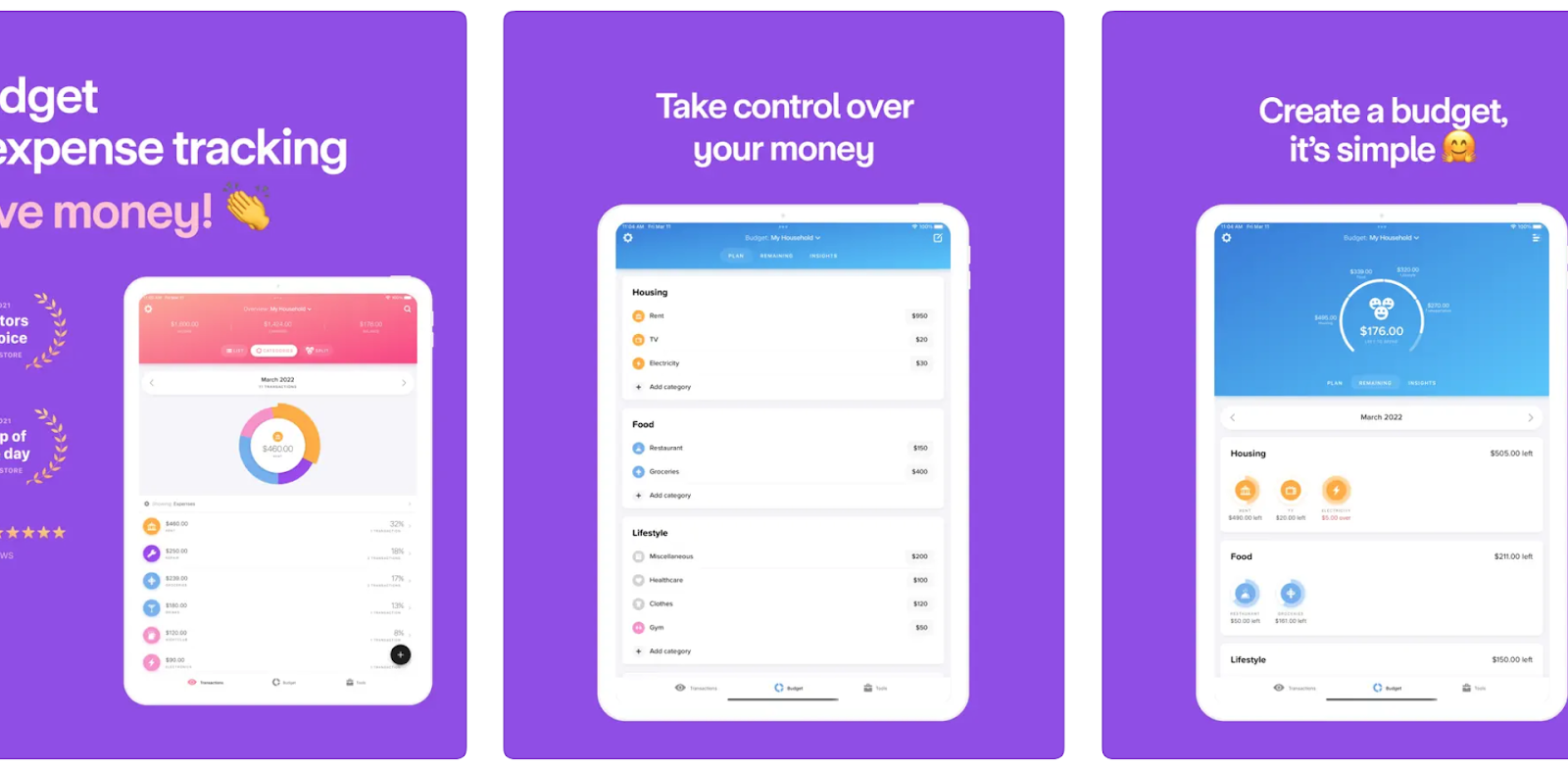

#1. Quicken Simplifi: Best for overall budgeting and expense tracking

- 🛡️ Key features: Real-time updates, Spending plan, and Savings goals

- 💲 Cost: Starts at $2.99 per month

- 📱 Mobile App Rating: iOS (4.2 Stars) & Android (4.3 Stars)

- 🆓 Free Trial: Yes, 30 days.

Why we chose this app

Quicken Simplifi sets itself apart with its ability to provide a detailed and personalized view of your finances. Unlike other budgeting apps, it offers a high level of customization. This allows you to tailor the app to fit your specific financial goals.

You can track every aspect of your financial life. This ranges from daily expenses to long-term savings goals. The Spending Plan feature further offers a proactive approach to budgeting. It forecasts your spending and income to ensure you stay on track throughout the month.

Pros

- This app keeps track of your finances with real-time data.

- Its goal tracking feature allows you to set and achieve financial goals with ease.

- You can personalize categories and budgets to fit your needs.

Cons

- The subscription fee may be a drawback for some users.

- This app is not as comprehensive, especially if you need detailed investment tracking.

Source: Quicken Simplifi

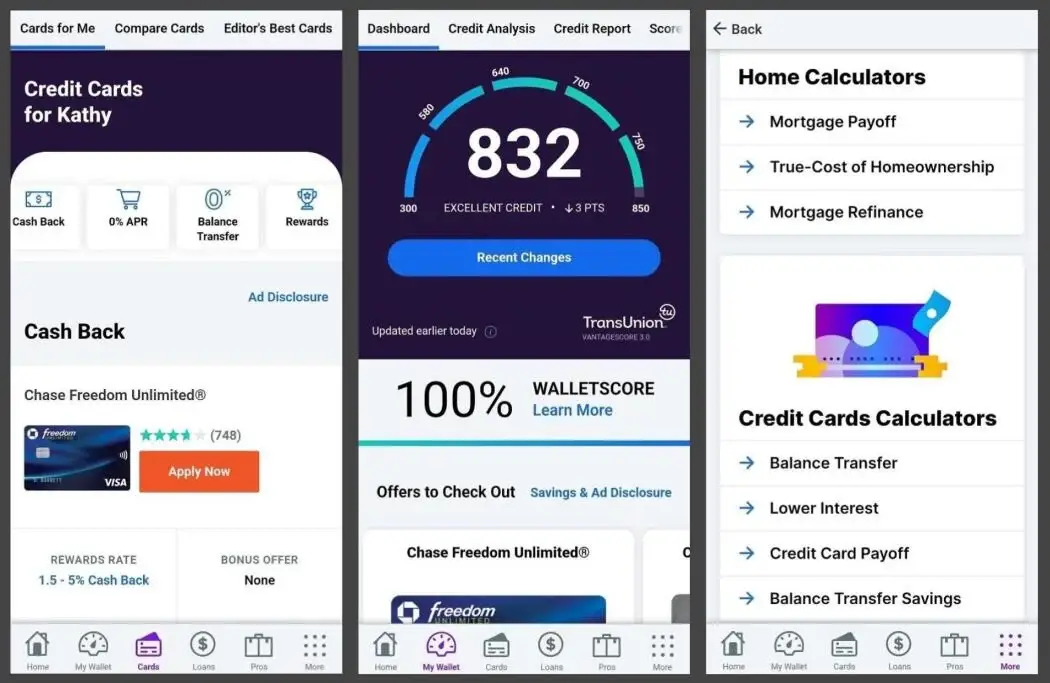

#2. WalletHub: Best for credit score monitoring and financial advice

- 🛡️ Key features: Daily credit score updates and Free full credit report

- 💲 Cost: Free

- 📱 Mobile App Rating: iOS (4.8 Stars) & Android (4.7 Stars)

- 🆓 Free Trial: It’s free

Why we chose this app

WalletHub serves multiple purposes. Primarily, it helps you monitor your credit score regularly and provides insights on how to improve it.

The app also offers personalized financial advice tailored to your unique situation. This can include recommendations on:

- reducing debt

- optimizing savings

- improving overall financial health.

Moreover, WalletHub features various financial calculators and tools to help you plan for future expenses and set realistic financial goals.

Pros

- You get real-time updates on your credit score. This helps you make prompt decisions on your financial status.

- It also gives you specific recommendations to improve your financial health.

Cons

- This app focuses more on credit monitoring. So you won’t have some of the most advanced budgeting features found in other personal finance apps.

- The app may include ads. This can feel intrusive.

Source: WalletHub

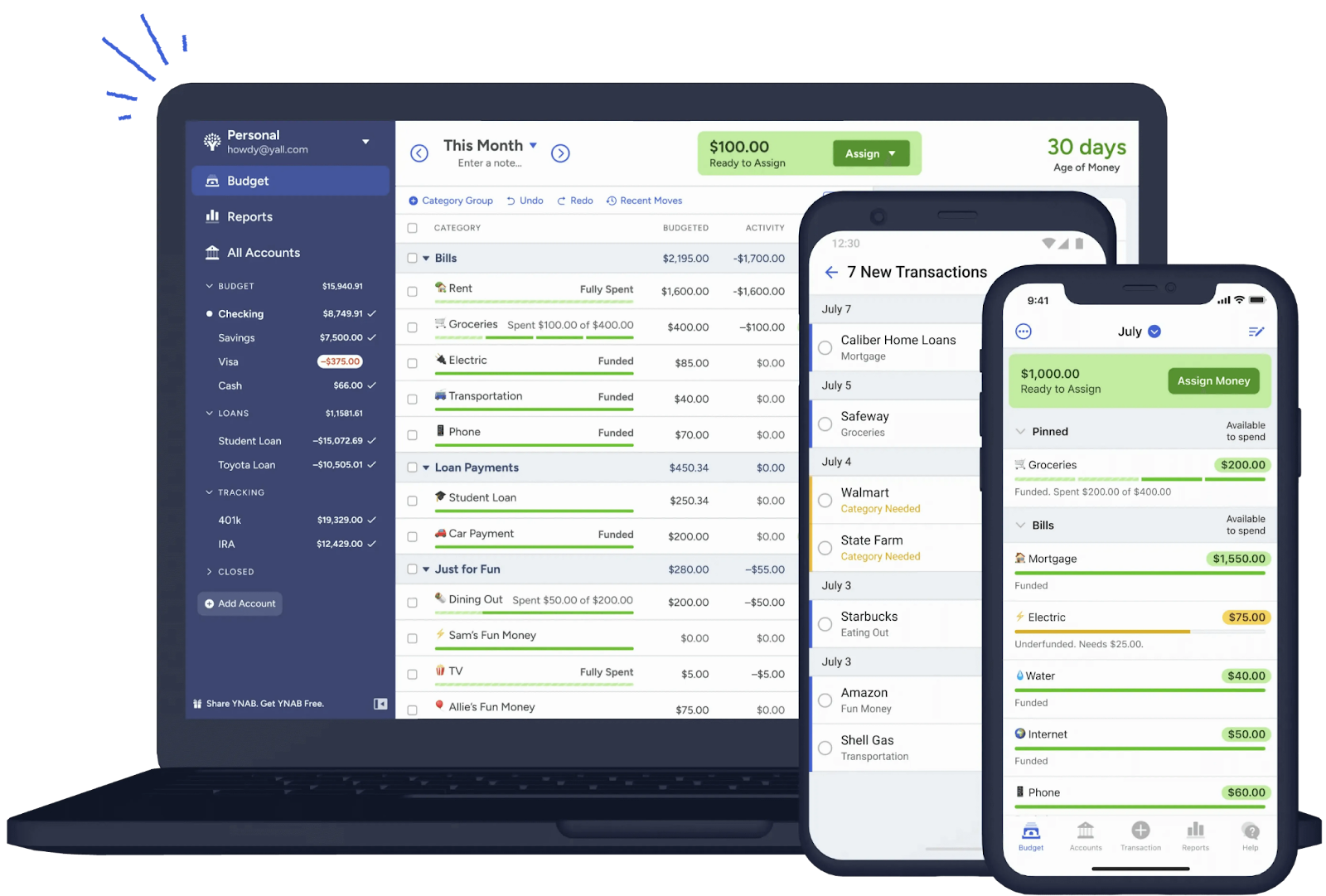

#3. YNAB: Best for proactive budgeting and debt reduction

- 🛡️ Key features: Debt paydown, Goal tracking, and Educational resources

- 💲 Cost: $14.99 per month

- 📱 Mobile App Rating: iOS (4.8 Stars) & Android (4.7 Stars)

- 🆓 Free Trial: Yes, 34 days.

Why we chose this app

We picked YNAB (You Need a Budget) for its proactive approach to budgeting and debt reduction. YNAB focuses on helping you take control of your finances. It encourages you to allocate every dollar you earn towards specific categories.

This approach makes it easier to see where your money is going. It also ensures you’re prepared for both expected and unexpected expenses. The app provides tools to help you do the following:

- track your spending

- categorize your expenses

- adjust your budget in real-time

It also offers educational resources to help you improve your financial literacy.

Pros

- YNAB’s approach to budgeting is easy to follow.

- The real-time sync ensures you have the latest information at your fingertips.

- The app also helps you create a plan to pay off your debts.

Cons

- YNAB’s subscription cost might be a barrier for you.

- You may need some time to get used to the app’s unique budgeting method.

- This app focuses mainly on budgeting and debt reduction. So you need an additional app if you need robust investment tracking.

Source: YNAB

#4. Rocket Money: Best for subscription management and bill tracking

- 🛡️ Key features: Subscription management, bill tracking, and spending insights

- 💲 Cost: $6-$12 per month

- 📱 Mobile App Rating: Android (4.3 Stars), iOS (4.2 Stars) & Trustpilot (4.5 Stars)

- 🆓 Free Trial: Yes, 7 days.

Why we chose this app

Rocket Money, formerly known as Truebill, excels in helping you manage subscriptions and track bills. It simplifies your financial life by giving you control over your recurring expenses.

We chose Rocket Money because it offers a comprehensive solution for managing your finances without the hassle of manual tracking. The app scans your bank statements to identify recurring charges. Even those you might have forgotten. That’s not all.

Rocket Money also offers a bill negotiation service. Experts negotiate with your service providers to lower your bills. This feature sets it apart from many other personal finance apps.

Pros

- Rocket Money makes it simple to manage subscriptions.

- You can potentially lower your monthly bills without any effort on your part. Thanks to the bill negotiation service.

- The app helps you stay organized. It provides a clear overview of recurring expenses.

Cons

- Some of the app’s most powerful features (such as bill negotiation) are only available with paid subscription.

- Relying solely on the app might make you less aware of your finances. You need to regularly check the details yourself.

Source: Rocket Money

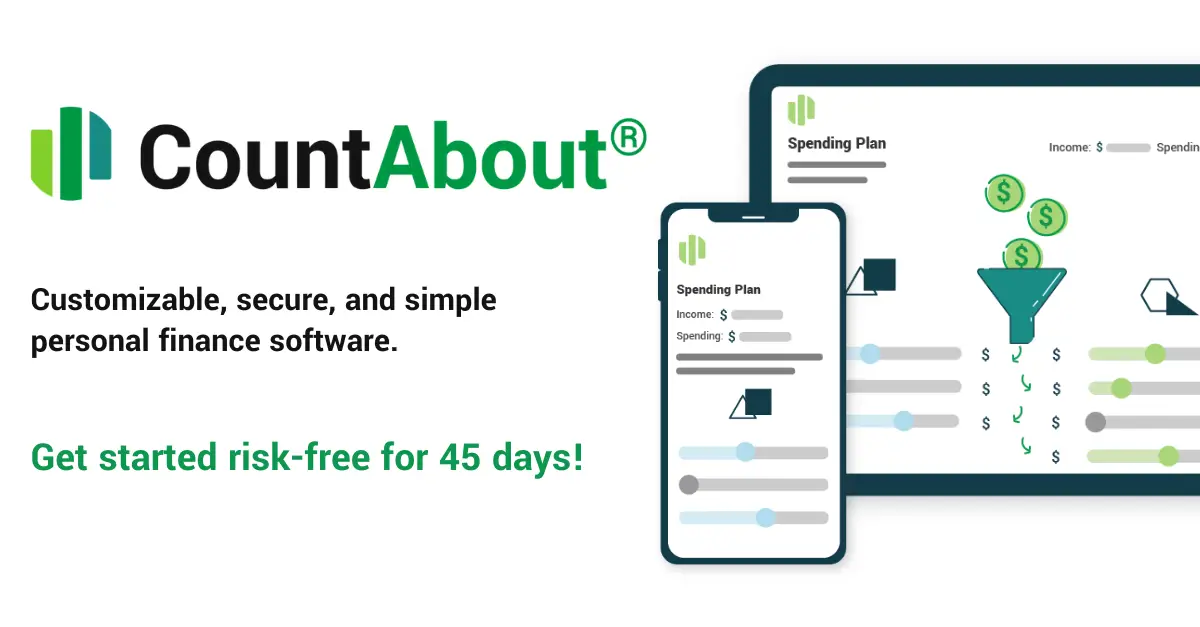

#5. CountAbout: Best for customizable budgeting

- 🛡️ Key features: Data import, customized categories, and detailed reporting

- 💲 Cost: $9.99 per year

- 📱 Mobile App Rating: Android (4.5 Stars) & iOS (4.2)

- 🆓 Free Trial: Yes, 45 days.

Why we chose this app

CountAbout is a top choice for customizable budgeting due to its flexibility and user-friendly features. We chose this app because it allows you to tailor your financial tracking to suit your specific needs.

CountAbout excels in providing a high degree of customization. This is crucial for those with unique financial situations. It supports importing data from popular financial platforms like Quicken and Mint.

The app’s ability to adapt to your specific budgeting preferences sets it apart from more rigid budgeting tools.

Pros

- You can easily import data from Quicken and Mint.

- The app gives you insights into your spending and income.

Cons

- It’s not simple to use. The extensive customization options might be overwhelming.

- The app lacks features for tracking investment. This might be a limitation for users looking for an all-in-one financial management tool.

Source: CountAbout

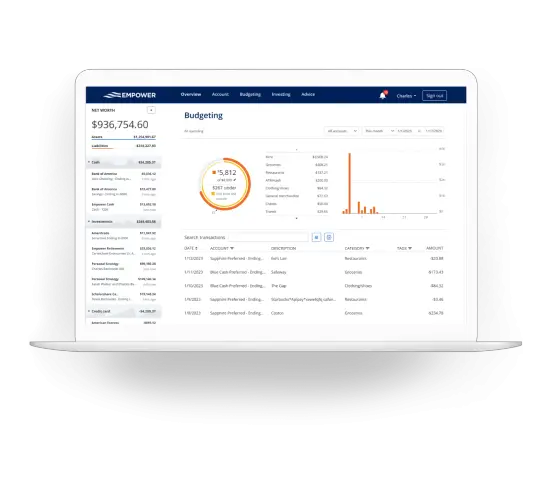

#6. Empower: Best for wealth management and retirement planning

- 🛡️ Key features: Retirement planner, cash flow tracking, and investment checkup

- 💲 Cost: Free

- 📱 Mobile App Rating: Android (4.0 Stars) & iOS (4.7 Stars)

- 🆓 Free Trial: It’s Free

Why we chose this app

We chose Empower because it excels in helping you manage your wealth and plan for retirement. It offers robust tools for long-term financial planning.

Empower has a reputation for providing insightful advice and comprehensive financial oversight. This makes it an ideal choice for those aiming to build and secure their financial future.

Here are a few things you may do with Empower Personal Dashboard:

- Keep track of your spending and see where your money goes.

- Plan for your future with detailed retirement planning tools.

- Monitor and manage your investments.

- Get a clear picture of your overall financial health by tracking your net worth.

- Set and track financial goals. Whether it’s saving for a home, college, or a vacation.

Pros

- It offers comprehensive financial management

- This tool gives you detailed insights into your cash flow, investment, and net worth.

Cons

- Like any financial app, there’s a risk associated with linking all your financial accounts in one place.

- The breadth of features might be overwhelming for those new to financial planning.

Source: Empower

#7. Honeydue: Best for couples managing finances together

- 🛡️ Key features: Bill splitting and shared financial overview

- 💲 Cost: Free

- 📱 Mobile App Rating: Android (3.7 Stars) & iOS (4.5 Stars)

- 🆓 Free Trial: It’s free

Why we chose this app

Honeydue lets you and your partner sync your bank accounts, track expenses, and budget together. This transparency helps avoid financial misunderstandings.

You can see all transactions in real-time, categorize spending, and set budget limits. The alerts and reminders ensure you pay bills on time. This reduces stress and financial strain.

This app’s collaborative nature is what makes it unique. Honeydue encourages communication and teamwork. Both partners can comment on transactions and share notes.

Pros

- The bill splitting feature simplifies managing shared expenses.

- You can see all your accounts, transactions, and budgets in one place.

Cons

- This may not be ideal for individuals.

- It may take time to get used to all the features.

Source: Honeydue

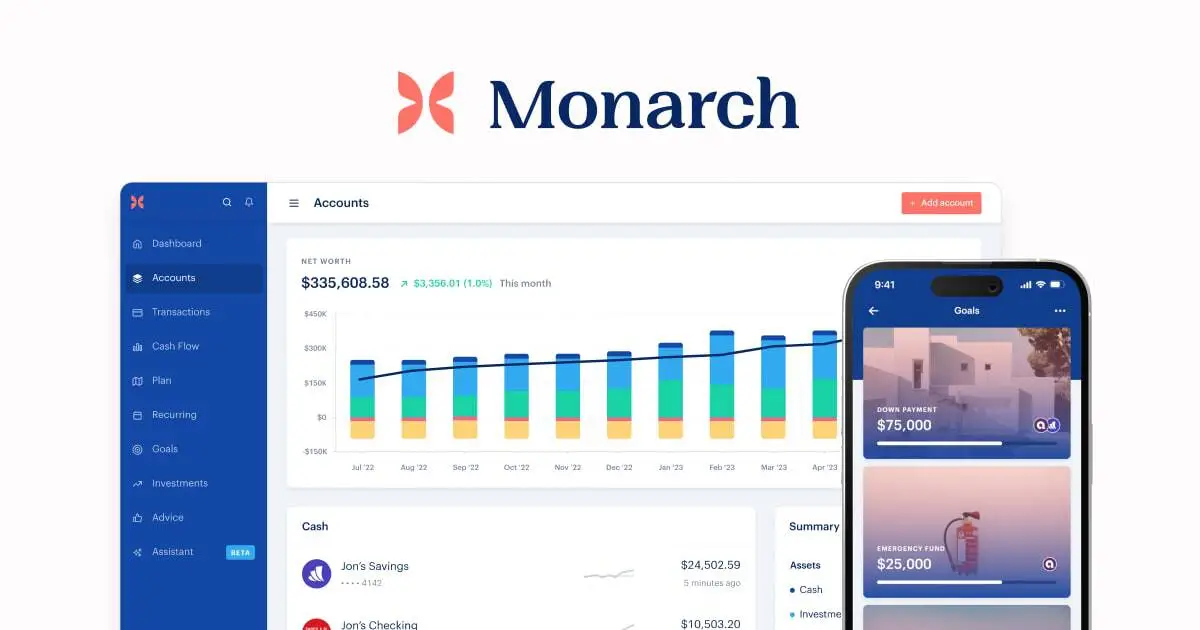

#8. Monarch Money: Best for comprehensive financial planning

- 🛡️ Key features: Couple’s planning, goal tracking, and financial insights

- 💲 Cost: $8.33 per month

- 📱 Mobile App Rating: Android (4.7 Stars) & iOS (4.9 Stars)

- 🆓 Free Trial: Yes, 7 days.

Why we chose this app

Monarch Money’s unique feature is its holistic approach to financial management. Many personal finance apps focus solely on budgeting or expense tracking.

However, Monarch Money provides tools for every aspect of your financial life. This all-in-one solution saves you time and effort. So, you don’t need multiple apps to manage your finances.

Monarch Money also offers personalized financial advice. This makes it easier for you to make informed decisions.

Pros

- Monarch Money covers all aspects of financial planning. This ranges from budgeting to investments.

- You can share your financial plans with family members to work together on achieving goals.

Cons

- The full version fee might be a barrier for some people.

- The app’s extensive features may be overwhelming at first. You need some time to learn how to use them.

Source: Monarch Money

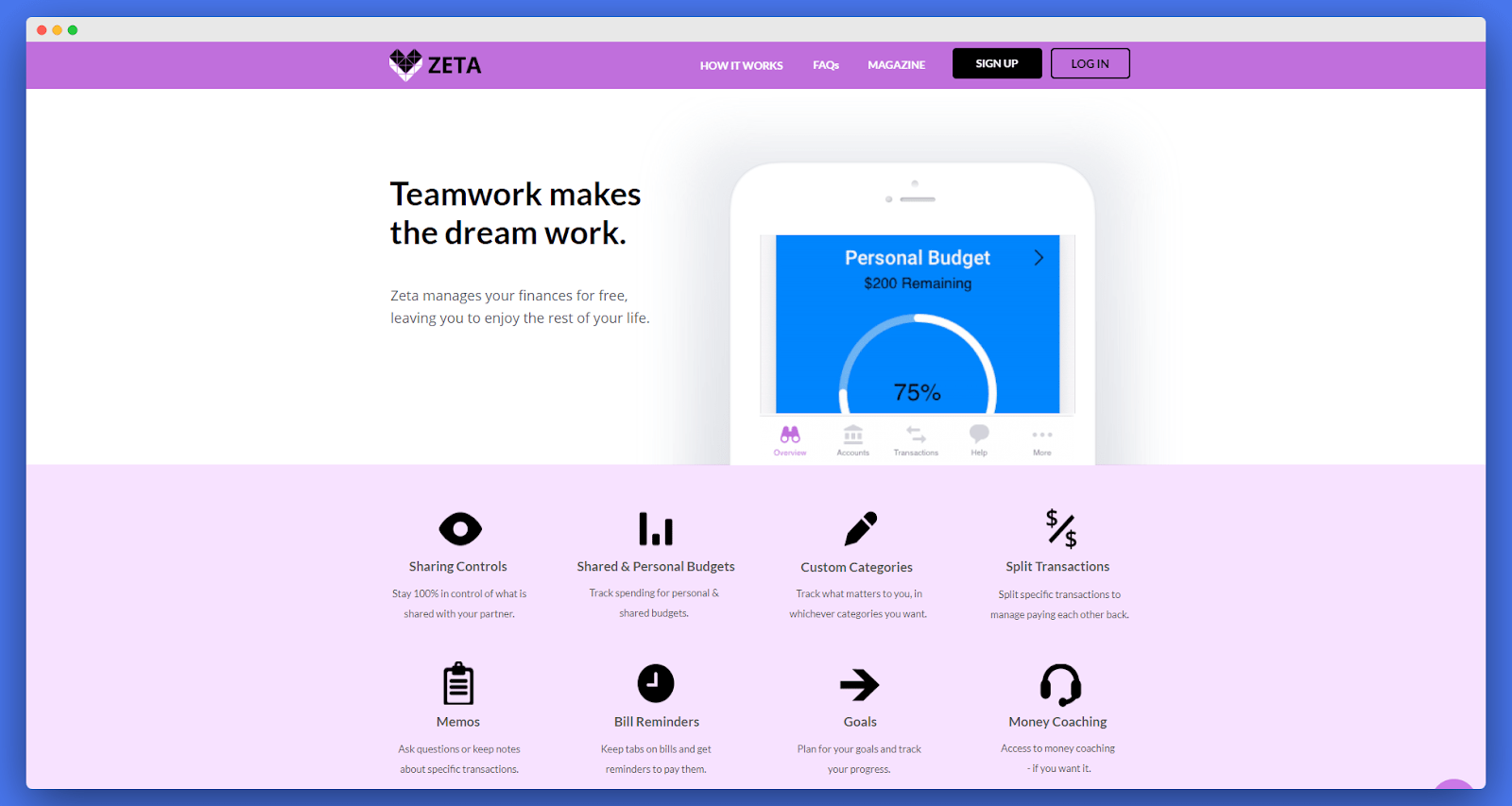

#9. Zeta: Best for couples’ shared finances and budgeting

- 🛡️ Key features: Bill reminders, expense tracking & joint and individual accounts

- 💲 Cost: $6.99 per month

- 📱 Mobile App Rating: iOS (4.5 Stars) & Android (3.7 Stars)

- 🆓 Free Trial: Yes

Why we chose this app

Zeta is specifically designed to help couples manage their finances together. This app simplifies the process of tracking shared expenses and setting budgets. You can also use it to plan for future financial goals. This may include saving for a house or a vacation.

Pros

- This app makes it easy to track and categorize expenses.

- It also gives you a complete picture of both individual and joint finances.

Cons

- The app is for couples. So, it’s not suitable for individuals.

- Its account linking features don’t support all banks.

Source: Zeta

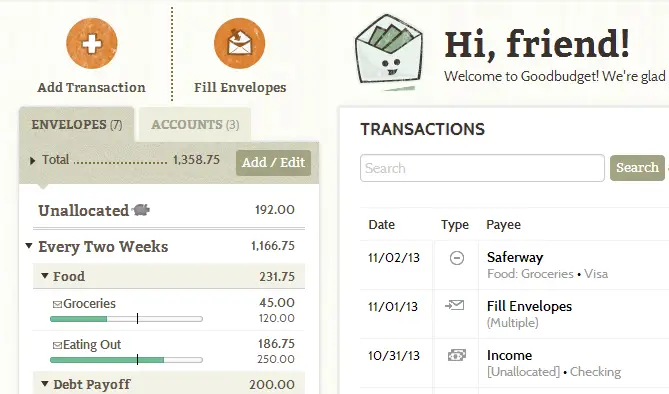

#10. Goodbudget: Best for envelope budgeting and expense tracking

- 🛡️ Key features: Envelope budgeting system & Multiple device syncing

- 💲 Cost: $10 per month

- 📱 Mobile App Rating: Android (4.0 Stars) & iOS (4.6 Stars)

- 🆓 Free Trial: Yes, Forever.

Why we chose this app

Goodbudget uses a virtual envelope system. This mimics the traditional method of dividing cash into envelopes for different expenses.

The system makes budgeting more tangible and easier to understand. Goodbudget also supports syncing across multiple devices. You and your family can stay on the same page financially.

Pros

- The envelope budgeting lets you allocate your funds efficiently.

- You can track your expenses in real-time. This keeps your budget updated.

Cons

- The free version has limited features. So you may have to upgrade to access all functionalities.

- Some users might find the envelope system unfamiliar.

Source: Goodbudget

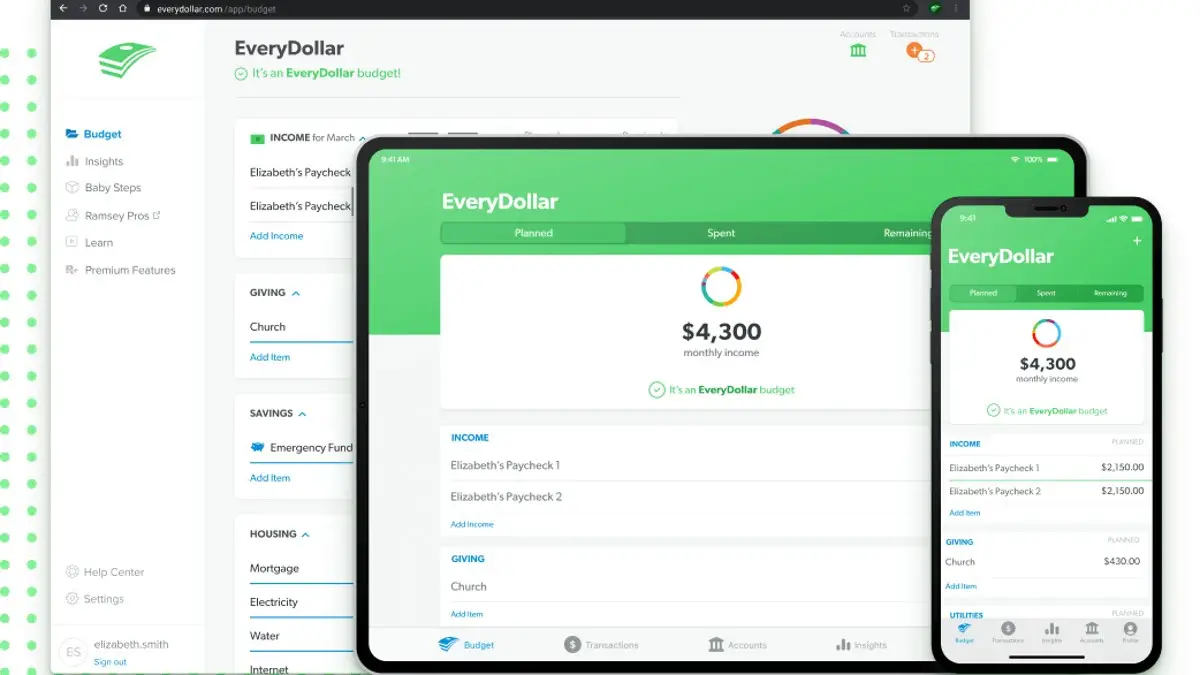

#11. EveryDollar: Best for zero-based budgeting

- 🛡️ Key features: Zero-based budgeting & Ramsey+ integration

- 💲 Cost: $17.99 per month

- 📱 Mobile App Rating: Android (3.3 Stars) & iOS (4.7 Stars)

- 🆓 Free Trial: Yes, 14 days.

Why we chose this app

EveryDollar is unique because it follows the zero-based budgeting method. This means you assign every dollar you earn to a specific category.

Whether it’s bills, groceries, savings, or entertainment. EveryDollar, developed by Dave Ramsey, helps you avoid unnecessary spending.

Pros

- This app encourages you to set and achieve financial goals.

- It is simple to use

Cons

- The free version lacks some advanced features available in the paid subscription.

- May take some time to get used to the zero-based budgeting method if you’re unfamiliar with it.

Source: EveryDollar

#12. Buddy: Best for shared budgeting and expense tracking

- 🛡️ Key features: Shared budgets & Expense tracking

- 💲 Cost: $9.99 per month

- 📱 Mobile App Rating: iOS (4.7 Stars)

- 🆓 Free Trial: Yes

Why we chose this app

Buddy stands out because it focuses on shared budgeting. Many apps are geared toward individual use, but Buddy understands the needs of families. It allows for easy collaboration.

This ensures everyone is on the same page financially. The unique approach helps prevent misunderstandings about money within families.

Pros

- Allows real-time syncing

- You get reminders for important financial tasks.

Cons

- Some advanced features are only available in the premium version.

- While generally easy to use, some users might need time to learn all features.

Source: Buddy

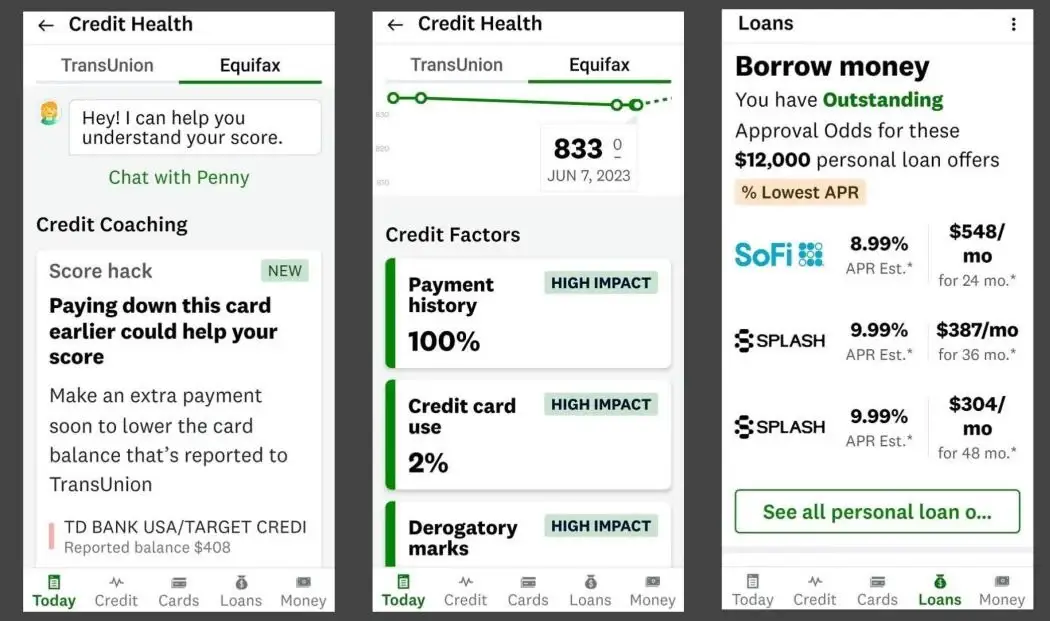

#13. Credit Karma: Best for free credit score monitoring and credit report insights

- 🛡️ Key features: Credit monitoring & Free credit scores and Reports

- 💲 Cost: Free

- 📱 Mobile App Rating: iOS (4.8 Stars) & Android (4.7 Stars)

- 🆓 Free Trial: It’s free

Why we chose this app

Credit Karma is free to use. Unlike many other services, you don’t need a credit card to sign up. The app provides two credit scores, one from TransUnion and one from Equifax.

You get regular updates and alerts when something changes in your credit report. It also provides a credit simulator to see how different actions might affect your score.

Pros

- You don’t have to pay to monitor your credit

- You get recommendations for credit products based on your profile.

Cons

- Only provides scores from TransUnion and Equifax, not Experian.

- The app funds itself through ads. This might be distracting.

Source: Credit Karma

#14. PocketGuard: Best for simple budgeting and tracking available spending money

- 🛡️ Key features: In My Pocket & Bill tracker

- 💲 Cost: $7.99 per month

- 📱 Mobile App Rating: Trustpilot (4.2 Stars), Android (3.7 Stars) & iOS (4.6 Stars)

- 🆓 Free Trial: Yes, there is a free version.

Why we chose this app

PocketGuard simplifies budgeting by providing a feature called “In My Pocket.” This shows you how much disposable income you have after covering essential expenses, bills, and goals.

Unlike other apps, PocketGuard’s main focus is on giving you a clear picture of your available spending money. This further makes budgeting less stressful.

Pros

- PocketGuard automatically categorizes expenses. This saves you time.

- Bill tracking ensures you never miss a payment.

Cons

- The free version has fewer features.

- Occasionally, the app might face issues syncing with certain banks or accounts

Source: PocketGuard

#15. Fudget: Best for quick budget creation without bank syncing

- 🛡️ Key features: Expense tracking and Budget creation tools

- 💲 Cost: $19.99 per year

- 📱 Mobile App Rating: iOS (4.7 Stars)

- 🆓 Free Trial: Yes, 7 days.

Why we chose this app

Many budgeting apps offer a wide range of features that can be overwhelming. Especially if you’re managing a tight budget. Fudget focuses on what’s essential. It helps you create and maintain a budget without the need for bank syncing.

You can manually enter your income and expenses. This gives you full control over your financial data.

Pros

- You don’t need to connect your bank accounts. This advantage ensures your financial data remains private.

- You can set up and start using this app within minutes.

Cons

- It’s time consuming to enter all your data manually.

- While the simplicity is a benefit, the app lacks some of the advanced features found in other budgeting tools.

- The free version includes ads. You need to upgrade to remove them.

Source: Fudget

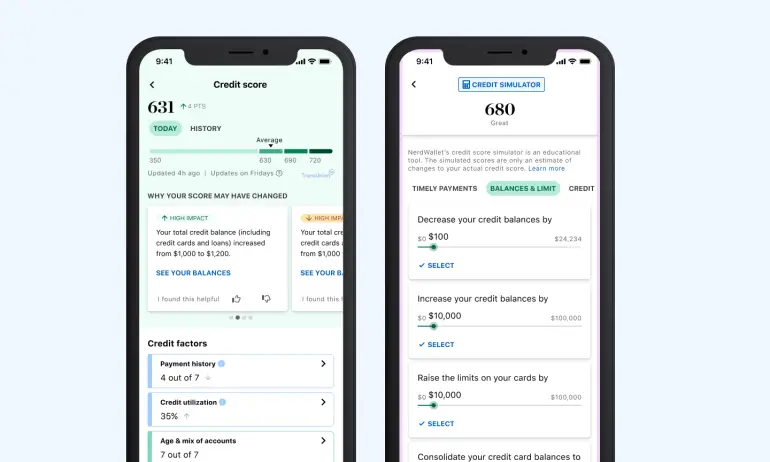

#16. NerdWallet: Best for managing your money

- 🛡️ Key features: Credit score tracking & Budgeting tools

- 💲 Cost: Free

- 📱 Mobile App Rating: Android (4.5 Stars) & iOS (4.8 Stars)

- 🆓 Free Trial: Free

Why we choose this app

NerdWallet assists you in various aspects of personal finance. It helps you monitor your credit score and manage your budget. This app also helps you find the best financial products like credit cards, loans, and insurance.

NerdWallet further provides financial insights and recommendations. This is usually based on your spending habits and financial goals.

Pros

- NerdWallet is accessible to users across all levels of financial knowledge.

- The app is free.

Cons

- As with any financial app, there are concerns about the security and privacy of your data.

- The sheer amount of information can be overwhelming for new users.

Source: NerdWallet

Tips to Help You Choose the Right Personal Finance App

The right personal finance app can make a big difference in managing your money. Here are some key tips to help you find the perfect app for your needs.

1. Be Clear About Your Financial Goals

Are you trying to save more, budget better, or reduce debt? Knowing your goals helps you select an app that aligns with your needs.

If your primary goal is saving, an app with automatic savings features will be the best option. For budgeting, look for apps that offer detailed tracking and reporting.

2. Evaluate App Features

Different apps offer various features. Look for those that provide what you need. Common features include:

- budgeting tools

- bill reminders

- savings goals

- expense tracking.

These tools help you stay organized and avoid missing payments. Or even overspending. So, an app with robust features will give you a comprehensive view of your finances.

3. Look for Security Measures

Your financial information needs protection. Ensure the app uses strong security measures. The most common ones are encryption and two-factor authentication. This keeps your data safe from hackers and unauthorized access.

4. Consider Integration Capabilities

Integration with your bank accounts and other financial services can save you time. Apps that sync with your bank accounts, credit cards, and investment accounts provide a real-time view of your financial status.

This seamless integration helps you track your spending and savings without manual updates. It makes your financial management more efficient and accurate.

5. Read Reviews and Ratings

User reviews and ratings can offer insights into the app’s performance and reliability. Reading reviews helps you avoid apps that might have hidden flaws or issues.

Look for reviews from people with similar financial situations to yours. High ratings and positive feedback usually indicate a well-functioning app.

6. Check for Customer Support

Reliable customer support can be a lifesaver if you encounter issues. Ensure the app provides adequate support options like live chat, email, or phone support. Good customer service means you can get help quickly when you need it.

7. Assess Cost and Value

Some apps are free, while others require a subscription or one-time purchase. Evaluate the cost against the features offered. A free app might suffice for basic needs, but a paid app could offer advanced tools worth the investment.

So, choose an app that provides the best value for your financial management needs without straining your budget.

8. Trial Periods and Demos

Many apps offer trial periods or demos. Take advantage of these to test the app before committing. A trial period lets you explore the app’s features and see if it meets your needs.

9. Customization Options

Personal finance is unique to everyone. Look for apps that allow customization. Features like custom budget categories and personalized alerts can make the app more effective for your specific needs. Customization ensures the app works the way you need it to, enhancing its usefulness.

Conclusion

These personal finance apps can make a real difference in your life. They help you budget, save, and plan for the future. Each app has unique features to suit your needs. Choosing the right one can simplify managing your finances.

You deserve the best tools to handle your money. A good app can relieve stress and give you more control. Review the options and pick the one that fits your situation.

If you found it useful, pass it along to friends and family. They might also benefit from these apps. Financial security is important for everyone. Your recommendation could make a big impact.

Frequently Asked Questions

Q1. What is a personal finance app?

This is an app that helps you manage your money. It tracks your expenses, income, and budgets. You can use it to set financial goals and monitor your progress.

These apps provide tools to simplify financial planning. This way, they improve your money management skills.

Q2. How do personal finance apps work?

Personal finance apps connect to your bank accounts, credit cards, and other financial institutions. They automatically import transactions and categorize them.

You can see all your financial information in one place. This helps you get a clear picture of your spending and saving habits.

Q3. Are personal finance apps safe?

Most personal finance apps use encryption to protect your data. They also employ security measures like two-factor authentication.

You should choose a reputable app with good reviews and a solid track record. Always use strong passwords and keep your app updated to ensure safety.

Q4. Do personal finance apps cost money?

Many personal finance apps offer free versions with basic features. Some apps have premium versions with additional features and no ads.

Premium versions might require a monthly or yearly subscription. We recommend comparing the features of free and paid versions to decide which one suits your needs.

Q5. Can personal finance apps help me save money?

Yes, personal finance apps can help you save money. They provide tools to create budgets and track spending. You can set savings goals and monitor your progress.

Alerts and notifications help you stay on track and avoid overspending. Some apps even offer tips and suggestions for saving money.

Q6. What features should I look for in a personal finance app?

Look for features that match your financial goals. Basic features include expense tracking, budgeting tools, and account synchronization.

Advanced features might include investment tracking, bill reminders, and credit score monitoring. A user-friendly interface and good customer support are important, too.

Q7. How can personal finance apps improve my budgeting?

Personal finance apps simplify budgeting by categorizing your expenses and income. You can set spending limits for different categories like groceries, entertainment, and utilities.

The app tracks your spending in real time and shows how much you have left in each category. This helps you avoid overspending and stick to your budget.