Are you finding it hard to plan for your financial future? Here are the best online financial planning services for low income families.

Financial planning services help you set financial goals and plan for the future. Online options offer convenience and accessibility. You can get expert advice without leaving your home.

These services can assist with budgeting, saving, investing, and debt management. They help you understand where your money goes.

Our article highlights the top online financial planning services for low-income families. You’ll learn about the features, benefits, and how to choose the best service for your needs.

Table of Contents

Best Online Financial Planning Services

Read on to learn how you can take control of your financial future today.

#1. The Paladin Registry: Best for finding vetted financial advisors

- 🔑 Key features: Free search tool & Vetted advisors

- 💼 Account Minimum: No

- 💸 Annual Fees: Free

Why we chose it

This service excels in transparency. You can see each advisor’s qualifications, expertise, and client reviews. This makes it easier to choose someone who understands your financial situation.

The Paladin Registry also provides resources to help you understand financial planning. These resources are especially useful if you’re new to managing money.

Pros

- You can trust the listed advisors to meet high standards.

- No cost to find and review advisor profiles.

- The detailed profiles help you make informed choices.

Cons

- Some listed advisors may charge fees that are too high for low-income families.

- The best advisors might not be available in your area.

Source: The Paladin Registry

#2. Savvy Ladies: Best for free financial education for women

- 🔑 Key features: Focuses on women’s financial issues.

- 💼 Account Minimum: No

- 💸 Annual Fees: Free

Why we chose it

Savvy Ladies provides education with a focus on women’s financial challenges. It is rare in the financial planning world. This often caters to more general audiences.

So, Savvy Ladies offers a judgment-free zone where you can learn at your own pace. The organization also provides resources that address issues such as:

- budgeting

- debt management

- planning for the future.

Pros

- Free financial advice

- Focuses entirely on women

- Offers personalized advice

Cons

- Provides basic financial advice.

- Oon-on-one counseling might have a waiting period.

Source: Savvy Ladies

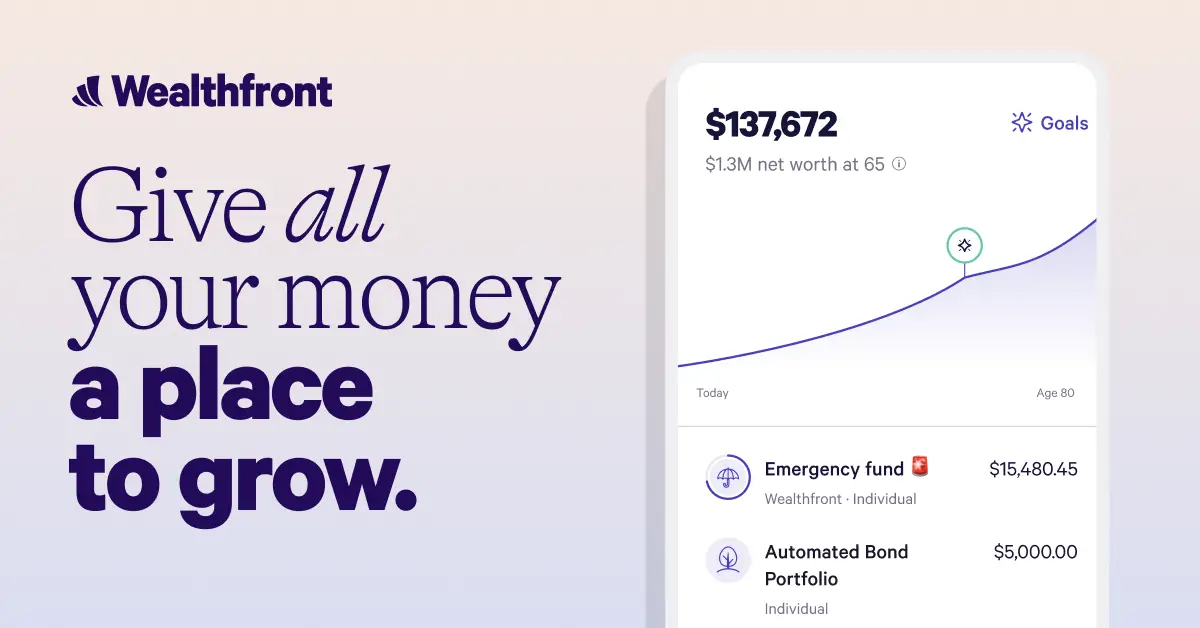

#3. Wealthfront: Best for low-cost automated investing

- 🔑 Key features: Path financial planning & Automated investing.

- 💼 Account Minimum: $500

- 💸 Annual Fees: 0.25% of your assets under management

Why we chose it

Wealthfront’s blend features makes it a strong contender. It boasts an automated investment process and planning tools. These allow you to focus on other important aspects of life.

Wealthfront’s algorithms adjust your portfolio to align with your investment objectives. You don’t need to be wealthy to access these sophisticated financial planning tools. This service also integrates with your bank accounts. It further provides a holistic view of your financial situation.

Pros

- This service includes tax-loss harvesting. It helps you save money on taxes.

- Path offers robust financial tools to help you achieve your goals.

- The 0.25% annual advisory fee is affordable. This is especially true compared to traditional personal financial advisors.

Cons

- The automated approach may not give you direct control over your investments.

- This service lacks the personal touch of a dedicated financial advisor.

- Wealthfront’s tools might not provide all the insights you need. This is a reality especially if your financial situation is complex.

Source: Wealthfront

#4. Charles Schwab: Best for comprehensive financial services

- 🔑 Key features: Retirement planning & Budgeting tools

- 💼 Account Minimum: No

- 💸 Annual Fees: No

Why we chose it

Charles Schwab offers robust financial planning services. The platform provides tools to help you manage your money.

Schwab’s comprehensive approach includes investment advice, budgeting help, and retirement planning. The service is popular for its strong customer support.

You get access to financial advisors who guide you through every step. The emphasis is on building a secure financial future. This way, it is suitable even for those with limited income.

Pros

- No advisory fee for Schwab Intelligent Portfolios.

- You can access certified financial planners.

- This platform also offers retirement planning services.

Cons

- May be too complex for beginners.

- This focuses on investment rather than financial advice. So, it may not be the best option.

Source: Charles Schwab

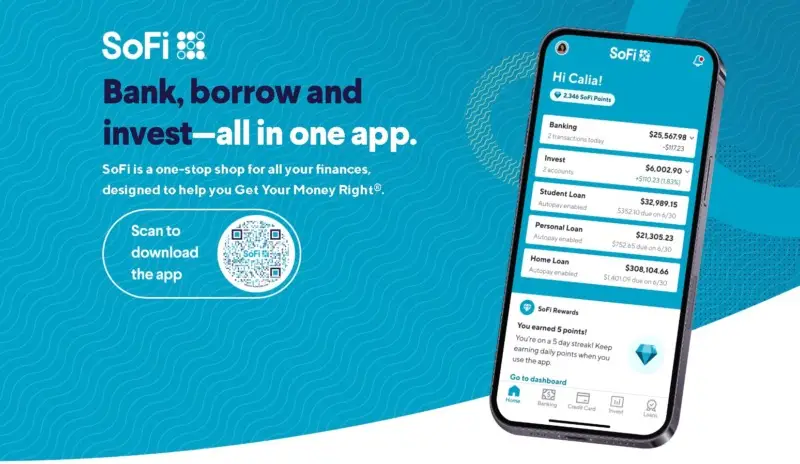

#5. SoFi Invest: Best for low-cost investing

- 🔑 Key features: Automated investing & Free access to financial planners.

- 💼 Account Minimum: No

- 💸 Annual Fees: $25 in inactivity fee

Why we chose it

SoFi Invest integrates financial planning with other financial products. This way, it provides a comprehensive financial ecosystem.

The service offers a variety of investment options. They match your risk tolerance and financial goals. You can also take advantage of SoFi’s educational resources and tools.

Pros

- Zero commission on trades helps you save money.

- No account management fees make investing affordable.

- Free access to certified financial planners provides expert advice.

- Educational resources improve your financial literacy.

Cons

- No direct access to human financial advisors. They are only available through scheduled sessions.

- The basic investment tools may not suit advanced investors.

Source: SoFi Invest

#6. Zoe Financial: Best for fiduciary advisor matching

- 🔑 Key features: Fiduciary advisors

- 💼 Account Minimum: $150,000

- 💸 Fees: $100-$500 per month

Why we chose it

Zoe Financial is ideal if you seek trustworthy financial advice on a limited budget. The free matching service makes it accessible.

It’s suitable for individuals and families who need comprehensive financial advice. Zoe Financial can help whether you are looking to manage debt, plan for retirement, or create a budget.

The service might favor those with more complex financial needs as well. Those with higher incomes might find the depth of available services appealing. But if you need honest financial advice, Zoe Financial is an excellent choice.

Pros

- Available nationwide.

- Offers comprehensive financial services.

- Free matching service.

Cons

- Some advisors may charge higher fees. This might be challenging if you have very limited resources.

- While all advisors are fiduciaries, the level of expertise varies. So you need to review profiles to find the best match for you.

Source: Zoe Financial

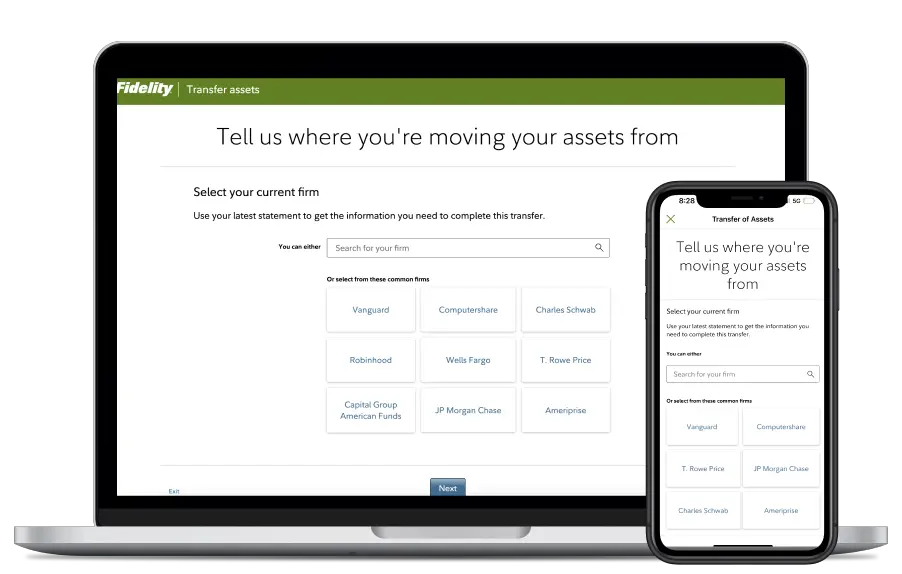

#7. Fidelity Investments: Best for investment options and tools

- 🔑 Key features: Robo-advisors & Financial planning tools

- 💼 Account Minimum: No

- 💸 Annual Fees: No

Why we chose it

Fidelity Investments is suitable for individuals at all income levels. Its low-cost and no-cost features make it favorable for you if you’re a low-income earner. The platform’s educational tools help you manage your finances.

Fidelity’s robo-advisors and comprehensive planning tools can provide the support you need. Especially if you only need guidance on how to plan for your future.

Other services might offer more tailored support. Particularly if you’re seeking personalized financial advice.

Pros

- Comprehensive financial planning tools

- Low-cost investment options

- Educational resources.

Cons

- Limited personalized advice.

- You may have to pay fees for certain services.

Source: Fidelity Investments

#8. Facet: Best for affordable personalized planning

- 🔑 Key features: Comprehensive personal finance services

- 💼 Account Minimum: No

- 💸 Fees: $250 one-time enrollment fee

Why we chose it

Facet pairs you with a certified financial planner who understands your financial situation. The service includes regular check-ins to adjust your plan as your life changes.

Their holistic approach covers every aspect of your financial life. You also enjoy the convenience of online consultations. This saves you time and travel expenses.

Pros

- The online platform is convenient.

- Facet adjusts your financial plan as your life circumstances change.

- Their personalized financial advice considers your unique financial situation.

Cons

- The service is online. It’s not the best fit for you if you prefer face-to-face meetings.

- Response times might vary. While you have regular check-ins, immediate responses might not be available.

Source: Facet

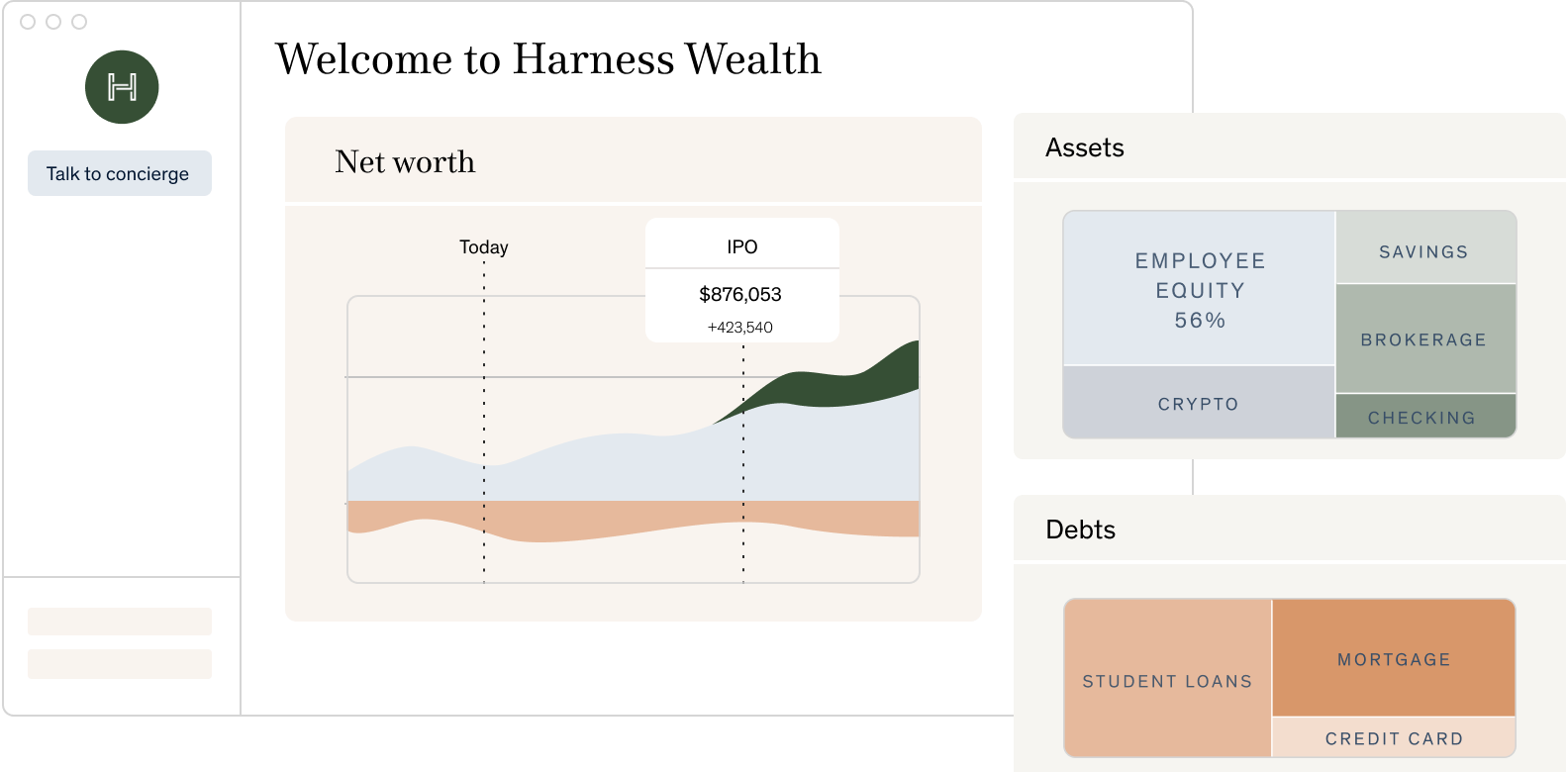

#9. Harness Wealth: Best for personalized planning and tax advice

- 🔑 Key features: Financial planning & Tax advice integration

- 💼 Account Minimum: $250,000

- 💸 Fees: One-time fee of between $2,000 to $3,000

Why we chose it

Harness Wealth stands out for its integration of financial planning and tax advice. You get a holistic approach to managing your finances. The platform’s advanced technology matches you with advisors who best fit your needs. This ensures that your financial plan is effective.

Pros

- You get financial and tax advice for your unique situation.

- This platform gives you a holistic approach to financial planning.

Cons

- This service might be expensive if you are on a tight budget.

- The extensive features may overwhelm.

Source: Harness Wealth

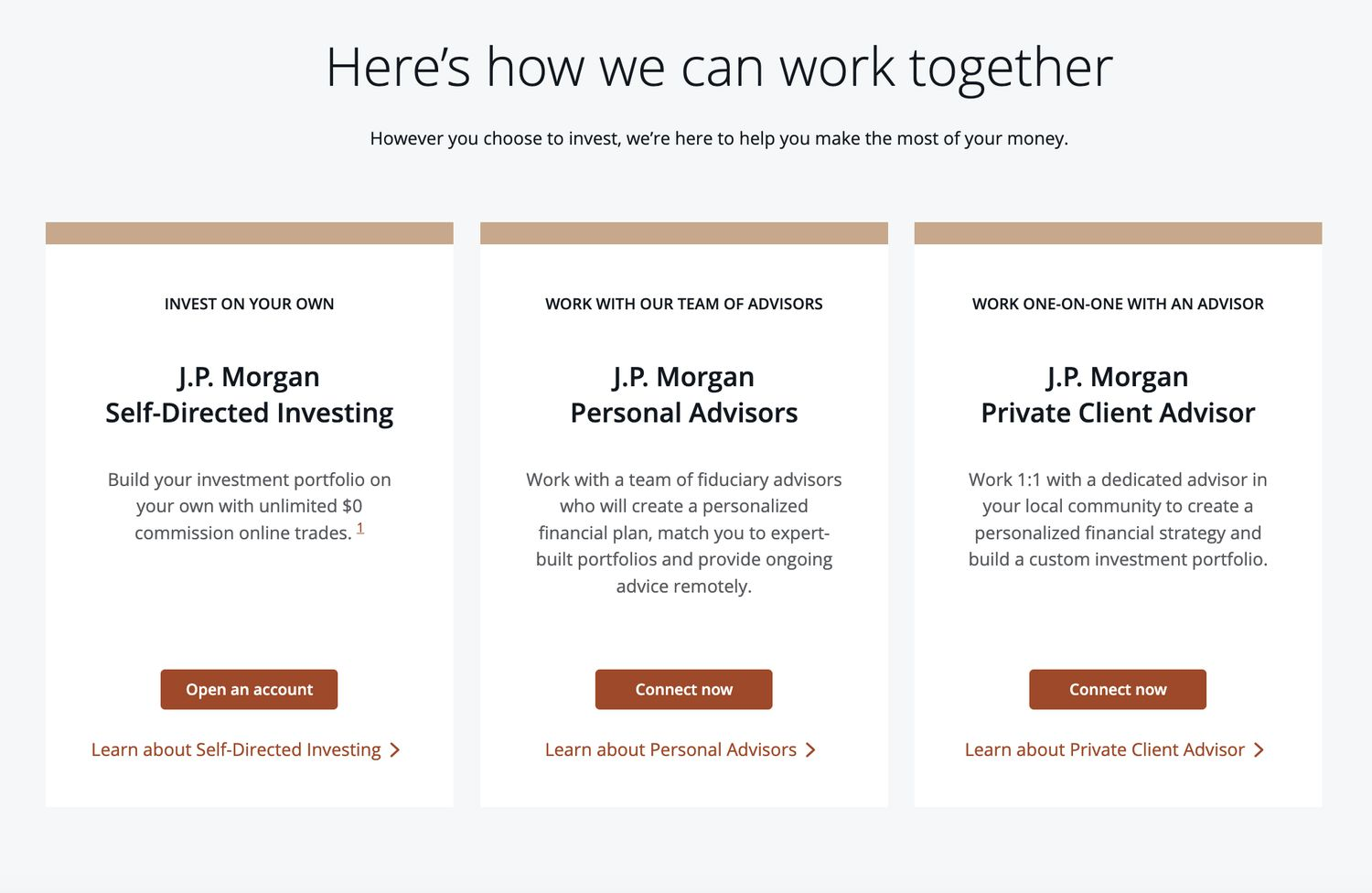

#10. J.P. Morgan Personal Advisors: Best for comprehensive planning

- 🔑 Key features: Expert advisors & Personalized financial plans

- 💼 Account Minimum: $25,000

- 💸 Annual Fees: 0.5%-0.6% of your assets under this firm’s management.

Why we chose it

The platform’s strength lies in its thoroughness. They cover a wide range of financial aspects. This ensures they don’t overlook any part of your financial life.

J.P. Morgan Personal Advisors offers robust financial planning for all income levels. Their comprehensive approach ensures you get tailored advice.

Their advisors work with you to understand your financial situation. They help you set realistic goals and create a plan to achieve them. This personalized service can be valuable if you’re managing a tight budget.

Pros

- It covers all aspects of financial planning.

- J.P. Morgan’s long history in finance offers trust and reliability.

Cons

- Services might be pricier compared to other options.

- The comprehensive nature of this service might feel overwhelming. Especially if you prefer simple solutions.

Source: J.P.Morgan Personal Advisors

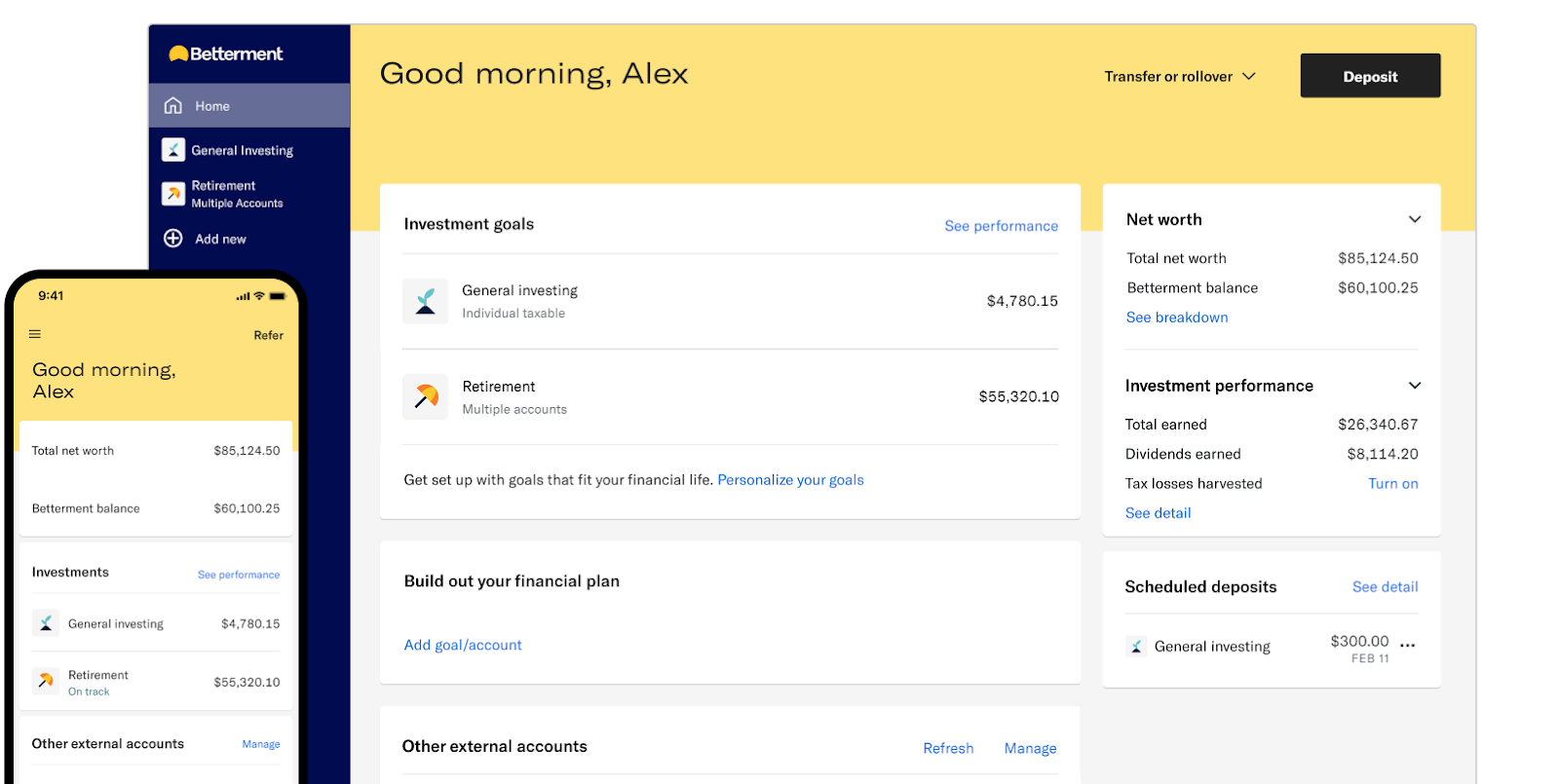

#11. Betterment: Best for automated financial planning

- 🔑 Key features: Tax-loss harvesting & Automated portfolio management

- 💼 Account Minimum: No

- 💸 Annual Fees: 0.25%-1% of your assets

Why we chose it

Betterment uses technology to provide a hands-off investment experience. This approach means you don’t need a deep understanding of the financial markets. The service rebalances your portfolio. It also reinvests dividends to ensure your money is always working for you.

Betterment also offers goal-based investing. It tailors your portfolio to specific financial objectives. This feature helps you stay focused and motivated.

Pros

- Automatic rebalances ensure your portfolio stays aligned with your financial goals.

- The personalized advice gives you customized recommendations based on your financial situation.

Cons

- Accessing human advisors requires a higher fee.

- Betterment’s automated approach may feel restrictive. This is especially if you want to choose specific investments.

Source: Betterment

Tips to Help You Choose the Right Financial Planning Service

Choosing the right financial planning service is more than picking a name from a list. It’s about ensuring you get the best possible advice tailored to your specific needs. Here are some tips to ensure you make an informed choice:

1. Understand Your Financial Goals

Do you need help with budgeting, debt management, or saving for the future? Identifying your priorities will narrow down your options.

This clarity saves you time. It also helps you focus on services that will address your immediate concerns.

2. Check Qualifications and Experience

Always check the qualifications and experience of the financial planner. Look for certifications like CFP (Certified Financial Planner) or CFA (Chartered Financial Analyst).

These qualifications confirm the planner has undergone rigorous training. They also show that the professionals adhere to professional standards. Experienced planners are more likely to offer better and practical solutions.

3. Look for Transparent Pricing

Some charge a flat fee, others take a percentage of your assets. Still, a few services may have hidden fees.

Transparent pricing helps you avoid unexpected costs. It ensures you know exactly what you’re paying for. This clarity allows you to budget better.

4. Read Reviews and Testimonials

Reading testimonials from other clients provide valuable insights into the service’s effectiveness. Positive reviews and high ratings reflect a reliable and trustworthy service.

Testimonials can highlight how the service has helped others in similar situations. This will give you confidence in their ability to assist you.

5. Ensure Fiduciary Responsibility

Ensure that your financial planner acts as a fiduciary. This means they act in your best interest, not their own.

Fiduciary responsibility ensures the advice you receive is without bias. This trust is vital for making decisions that impact your financial future.

6. Consider Communication Style

Effective communication is key to a successful financial planning relationship. Make sure the planner explains complex financial concepts in simple terms. They should also be patient with your questions.

A planner who communicates well can help you understand your financial situation better. This clarity reduces the stress often associated with financial planning.

7. Check for Comprehensive Services

Look for a financial planning service that offers a comprehensive range of services. These include budgeting, retirement planning, investment advice, and debt management.

Comprehensive services cover all aspects of your financial life. This all-encompassing support helps you tackle multiple financial challenges with one trusted advisor.

8. Test Customer Service

Good customer service is a sign of a reputable financial planning service. Test their customer service by contacting them with questions before you sign up.

Responsive and helpful customer service indicates that the company values its clients. This reassurance can make you feel more comfortable and confident in your choice.

9. Consider Digital Tools and Resources

Many financial planning services offer digital tools to help you manage your finances. These can include budgeting apps, investment trackers, and educational materials.

Digital tools make it easier to stay organized and keep track of your progress. Utilizing these resources can simplify financial management.

10. Verify Their Approach to Goal Setting

A good financial planner will help you set realistic and achievable goals. Verify their approach to goal setting. Ask how they will help you develop and track your financial objectives.

Effective goal setting provides a clear path to financial success. This structured approach ensures that you make steady progress toward your financial aspirations.

Conclusion

The online financial planning services we’ve discussed can make a difference for you. They help you save, invest, and manage money.

But take your time to explore the options. You should choose the one that meets your specific needs.

If you found this article helpful, share it with friends and family. They might also take advantage of these services, too. Financial planning doesn’t have to be overwhelming. You can achieve your financial goals with the right tools and guidance.

Frequently Asked Questions

Q1. What are financial planning services?

These are services that help you create a roadmap for your financial future. They include budgeting, investing, tax planning, and retirement planning.

Financial planners:

- assess your current situation

- set financial goals

- develop strategies to achieve them.

Q2. How can financial planning services benefit me?

Financial planning services offer several benefits. They help you:

- manage your money

- reduce financial stress

- ensure long-term financial security.

Professional guidance allows you to optimize your investments and reduce taxes. You gain a clearer understanding of your financial goals. Plus, the steps needed to achieve them.

Q3. When should I start using financial planning services?

The best time to start is now. Financial planning services can help you at all stages of your career. Early planning maximizes benefits, but it’s never too late to start.

Q4. What are the costs of financial planning services?

Costs vary depending on the services and the planner’s fee structure. Some planners charge a flat fee, while others take a percentage of your assets.

Hourly rates and commission-based fees are also common. So you should understand the fee structure upfront. Consider the value of the services relative to the cost.

Q5. Can financial planning help with debt management?

Yes, financial planning can aid in debt management. Planners assess your debt situation and create a repayment strategy.

They help prioritize debts and negotiate with creditors. These professionals also find ways to reduce interest rates. Effective debt management frees up resources for saving and investing. This improves your overall financial health.