Do you need reliable credit repair services? Here are the best credit repair companies for low income families.

Low credit score affects your ability to get loans, rent an apartment, or even secure a job. This is where many people turn to credit repair services.

While you can repair your credit score alone, it is often time-consuming. The process may be confusing, too. But credit repair companies simplify this process. They identify errors on your credit report and challenge them.

Some even provide personalized advice to help you improve your credit score. You need to pick the best credit repair company. This will increase your chances of successfully removing inaccuracies from your credit report.

We’ve compiled the best credit repair companies to help you choose the best one.

Table of Contents

Best Credit Repair Companies

Simply put, a credit repair company is a business that offers services to improve the credit scores of its clients. Check out the best credit repair companies in the list below:

#1. Credit Saint: Best for aggressive credit repair

- ✨Key features: Aggressive disputes and credit education.

- 💰Setup fee: $99 or $195

- 📅Monthly fee: $79.99-$119.99

- 🛒Availability: 42 States

- 🔙 Money-back guarantee: Yes, 90 days.

Why we chose this company

Credit Saint is unique for its clear and transparent process. They give you detailed information on how they will improve your credit score. Their focus on aggressive dispute tactics means they don’t shy away from hard cases. You also get a money-back guarantee to show their confidence in their service.

This service may not be available if you live in the following states:

- South Carolina

- Kansas

- Minnesota

- Oregon

- Georgia

- District of Columbia

- Maine

- Mississippi

Pros

- The aggressive approach quickly addresses negative items on your credit report.

- Money-back guarantee gives you a risk-free way to try their service.

- They are clear about what they will do and how they will do it.

- You can easily track your progress and see results in real-time.

Cons

- While there are budget options, the most aggressive plans are pricier.

- This service is not available in all states.

- The one-time fee could be a barrier for very low-income families.

Source: Credit Saint

#2. Lexington Law: Best for legal expertise and extensive resources

- ✨Key feature: Legal expertise

- 💰Setup fee: No such fees

- 📅Monthly fee: $59.95-$139.95

- 🛒Availability: 49 States

- 🔙 Money-back guarantee: No

Why we chose this company

Lexington Law offers something unique: a law firm’s backing. This means you get legal experts who know how to handle complex credit issues. Their deep understanding of credit regulations allows them to challenge inaccuracies more effectively than many competitors.

This company is a top contender if you have been struggling with inaccuracies on your credit report. Their range of services and flexible plans make them accessible even if you are on a tight budget.

Pros

- Lawyers handle your case to ensure a thorough and legal approach to credit repair.

- They have extensive experience in the industry with a solid track record. So, you’ll get the best services.

- You have access to resources to help you understand and improve your credit.

Cons

- Has higher monthly fees compared to some competitors.

- Credit repair can be a lengthy process. The results are not immediate.

- These services are not available in Oregon state.

Source: Lexington Law

#3. CreditRepair.com: Best for personalized credit repair plans

- ✨Key features: Free credit evaluation and credit score tracker

- 💰Setup fee: $69.95

- 📅Monthly fee: $69.95-$119.95

- 🛒Availability: 38 States

- 🔙 Money-back guarantee: Yes, 90 days

Why we chose this company

CreditRepair.com differentiates itself through its thorough initial credit consultation and individualized action plans. Each plan targets the unique financial situation of the client. It addresses specific issues on their credit reports.

This company also emphasizes a hands-on approach. They offer continuous support and education throughout the credit repair process.

You can’t use this company if you are in the states below:

- Colorado

- Kansas

- Georgia

- Minnesota

- Maine

- Michigan

- Ohio

- Wisconsin

- South Carolina

- Maryland

- Oregon

- Mississippi

Pros

- The personalized approach offers strategies based on your credit situation.

- No cost for initial consultation.

Cons

- Monthly fees may be higher than some competitors

- Services are not available in 12 states.

- Their credit repair may take several months.

Source: CreditRepair

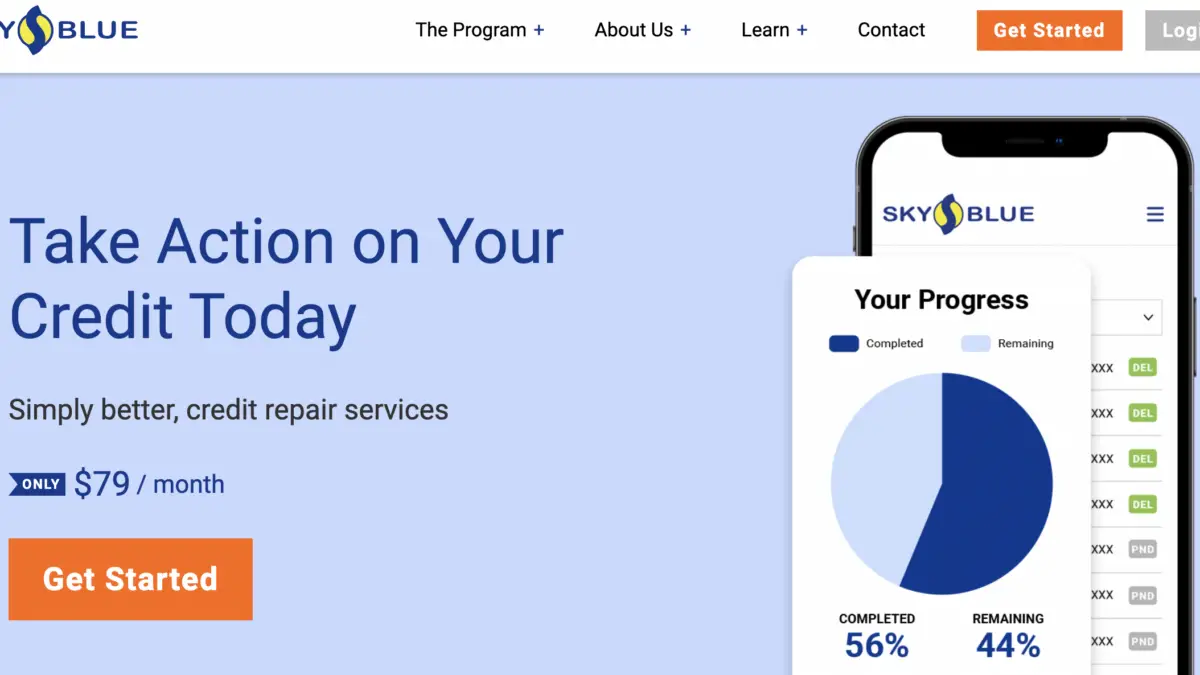

#4. Sky Blue Credit Repair: Best for simplicity and affordability

- ✨Key features: 45-day dispute cycles, and discounts for couples

- 💰Setup fee: $79

- 📅Monthly fee: $79-$119

- 🛒Availability: 50 States

- 🔙 Money-back guarantee: Yes, 90 days.

Why we chose this company

Sky Blue Credit Repair excels in keeping things simple. They focus on making the credit repair process easy to understand and follow.

The company provides a comprehensive analysis of your credit report and disputes any errors efficiently. They also offer personalized tips to help improve your credit score beyond just dispute resolution.

Pros

- At $79 per month, it’s one of the most cost-effective options available.

- The service is designed to be easy to use, with clear steps and explanations.

- Disputes are processed quickly to improve your credit score faster.

- This company is risk-free with a money-back guarantee if you’re not satisfied within the first 90 days.

- You can also save money if both partners need credit repair.

Cons

- Focuses mainly on credit repair. So, it doesn’t offer many additional financial services.

- It may take longer to repair your credit.

Source: Sky Blue Credit Repair

#5. The Credit People: Best for budget-friendly services

- ✨Key features: Quick setup and free credit reports

- 💰Setup fee: $19

- 📅Monthly fee: $99-$139

- 🛒Availability: 50 States

- 🔙 Money-back guarantee: Yes, 6 months.

The Credit People stands out due to their straightforward pricing. They don’t charge hidden fees or extra costs that surprise you later. The simple and transparent fee structure helps you plan your finances better. You know exactly what you’re paying for and what to expect in return.

Pros

- Their services are budget friendly.

- You can try their service risk-free for 90 days.

Cons

- They focus mainly on credit repair. So, you may not find a lot of additional financial services.

Source: The Credit People

#6. The Credit Pros: Best for AI-driven credit solutions

- ✨Key features: AI-powered credit repair and transparent pricing

- 💰Setup fee: $119, $129, or $149

- 📅Monthly fee: $69-$149

- 🛒Availability: 43 States

- 🔙 Money-back guarantee: Yes, 90 days.

Why we chose this company

The Credit Pros combines human expertise with advanced AI technology. Their AI system analyzes your credit reports, identifies errors, and suggests the best course of action. This integration of technology and personal touch sets them apart in the credit repair industry.

The Credit Pros is not available in any of the states below:

- South Carolina

- Minnesota

- Oregon

- Maine

- California

- Kansas

- Georgia

Pros

- You benefit from precise and personalized credit repair strategies. Thanks to advanced AI technology.

- You can track your credit repair progress online or via their mobile app.

Cons

- Cost is higher than some budget-friendly options on this list.

- Their heavy reliance on AI might not appeal to those preferring a more traditional approach.

Source: The Credit Pros

#7. Credit Versio: Best for DIY credit repair

- ✨Key feature: AI-powered dispute automation

- 💰Setup fee: No such fees

- 📅Monthly fee: $24.95-$29.95

- 🛒Availability: All 50 states

- 🔙 Money-back guarantee: No.

Why we chose this company

Credit Versio offers a unique, user-friendly software that guides you through the credit repair process. The software analyzes your credit reports and suggests the best strategies for disputing inaccuracies.

This DIY approach reduces costs. It also helps you understand how credit works. This further helps you make better financial decisions in the future.

Pros

- The AI-powered tools simplify the dispute process.

- This platform provides you with valuable insights about credit.

- They have a lower cost compared to traditional credit repair services.

- You can also access credit monitoring services on the same platform. Here, they also up to $1m in identity theft insurance.

Cons

- This DIY approach requires time and effort to manage the disputes.

- May not offer as much hands-on assistance as full-service companies.

Source: Credit Versio

#8. Credit Firm: Best for straightforward credit repair

- ✨Key features: Affordability, personalized service, and transparent pricing.

- 💰Setup fee: No such fees.

- 📅Monthly fee: $49.99

- 🛒Availability: All 50 States

- 🔙 Money-back guarantee: No.

Why we chose this company

Credit Firm stands out because of its simple and effective process. They don’t bombard you with unnecessary jargon or confusing steps.

Instead, they focus on identifying errors in your credit report and disputing them efficiently. Their method is clear-cut and designed to get results without causing additional financial stress.

This credit repair company is perfect for families on a tight budget who need to improve their credit scores. It’s suited for those who need reliable help to remove errors from their credit reports.

Pros

- This is one of the most affordable options available on the market.

- The Credit Firm has no hidden fees. You know exactly what you’re paying for.

- They offer solutions tailored to your specific credit issues

Cons

- Has fewer additional financial tools compared to the others.

- It may take time to see significant changes in your credit score.

Source: Credit Firm

#9. Credit Glory: Best for fast credit improvement

- ✨Key features: Speedy service and free consultation

- 💰Setup fee: $299

- 📅Monthly fee: $99

- 🛒Availability: All 50 States

- 🔙 Money-back guarantee: Yes, 90 days.

Why we chose this company

Credit Glory stands out for its swift credit repair services. You want quick results when dealing with credit issues. Credit Glory delivers just that. This company prioritizes efficiency to ensure you see improvements in your credit score as soon as possible.

The team is proactive and responsive. They offer a free consultation to evaluate your situation. Then they recommend the best course of action.

Pros

- Quick turnaround time for credit improvement.

- Regular updates on your credit repair progress.

- There is no-cost initial consultation to understand your needs.

Cons

- Has a higher set up fee than some competitors.

- Has limited financial planning resources to help you.

Source: Credit Glory

#10. Trinity Credit Services: Best for financial education

- ✨Key features: Educational resources and personalized credit repair plans.

- 💰Setup fee: $1

- 📅Monthly fee: Not advertised.

- 🛒Availability: 48 States

- 🔙 Money-back guarantee: Yes.

Why we chose this company

Trinity Credit Services offers a unique blend of credit repair and financial education. Many companies focus solely on removing negative items from your credit report, but Trinity goes a step further.

They provide resources and tools to help you to do the following:

- understand how credit works

- manage your finances better

- avoid future credit issues.

This dual approach ensures you repair your credit. You also gain the knowledge to keep it healthy. Unfortunately, this service is not available in Massachusetts and Georgia.

Pros

- You get more than just credit repair. You learn how to manage your finances better.

- Trinity provides credit repair plans that address your specific needs.

- The company has a knowledgeable staff that understands credit laws.

Cons

- You need to invest some time and effort to see the best results. Repairing credit and improving financial literacy takes time.

- While Trinity’s approach is thorough, it might take longer to see results.

Source: Trinity Credit Services

#11. Pyramid Credit Repair: Best for excellent customer support

- ✨Key features: Comprehensive dispute process and support for all 3 credit bureaus

- 💰Setup fee: Not advertised

- 📅Monthly fee: $89-$179

- 🛒Availability: 50 States

- 🔙 Money-back guarantee: No.

Why we chose this company

Pyramid Credit Repair stands out due to its personalized approach. Every customer gets a dedicated account manager. This ensures you receive tailored advice and assistance. They offer a risk-free assessment. This provides peace of mind and confidence in their services.

Pros

- No hidden fees.

- Manages all aspects of the credit repair process.

- Provides valuable information to help you maintain a good credit score in the long term.

Cons

- While the services are comprehensive, they may still be expensive for some.

- Credit is not instant. So it can take several months to see results.

Source: Pyramid Credit Repair

#12. Bolster: Best for holistic credit and financial wellness

- ✨Key features: Budgeting tools and debt management assistance

- 💰Setup fee: No

- 📅Monthly fee: Not advertised

- 🛒Availability: All 50 States

- 🔙 Money-back guarantee: Not advertised

Why we chose this company

Bolster integrates credit repair with financial education. They provide tools and resources to help you understand credit, manage debt, and budget effectively. This dual approach empowers you to take control of your financial future, beyond just improving your credit score.

Pros

- They offer strategies to reduce and manage debt.

- They also tailor their services to meet your unique needs.

Cons

- This credit repair app may take longer to help you repair your credit issues.

Source: Bolster.

#13. Safeport Law: Best for legal protection and credit repair

- ✨Key features: Legal expertise and comprehensive credit repair

- 💰Setup fee: $129 billed 6 days after you enroll.

- 📅Monthly fee: $95.95-$129.99

- 🛒Availability: Not available in South Carolina

- 🔙 Money-back guarantee: Yes, 90 days.

Why we chose this company

Safeport Law uniquely blends credit repair with legal protection. Unlike most credit repair companies, Safeport Law employs legal experts to tackle complex credit issues.

Their team understands consumer rights and uses this knowledge to challenge unfair practices. This legal edge ensures that you see improvements in your credit scores. You also receive protection against predatory practices.

Pros

- You get legal support alongside credit repair.

- Services are tailored to your specific needs.

- You also learn how to manage your credit better.

Cons

- Legal services may increase the overall cost.

- Legal processes can take longer than standard credit repair.

Source: Safeport Law

12 Tips to Help You Choose the Right Credit Repair Company

The right credit repair company can make a huge difference in improving your credit score. Here are some tips to help you find the best option for your needs.

1. Check for Accreditation

Look for companies accredited by the Better Business Bureau (BBB) or the National Association of Credit Services Organizations (NACSO). This reflects the company’s commitment to ethical practices. It helps you trust that you’re working with a reliable partner.

2. Read Reviews and Testimonials

Customer feedback provides insight into the company’s reputation. Reviews and testimonials from past clients reveal their experiences and satisfaction levels. This information highlights the company’s strengths and weaknesses.

3. Inquire About Fees and Costs

Different companies have different fee structures. This may include monthly fees, setup fees, and per-dispute fees.

So, knowing the costs upfront helps you avoid unexpected expenses. This is important for managing your budget.

4. Verify Their Track Record

A proven track record indicates the company’s success in helping clients improve their credit scores. Ask for case studies or success stories. This information will help you determine the company’s effectiveness.

5. Evaluate Customer Support

Effective customer support enhances your experience with the credit repair process. A company with helpful customer service can address your concerns and provide timely updates. This ensures you feel supported throughout the process.

6. Ensure They Follow Legal Guidelines

Credit repair companies must comply with the Credit Repair Organizations Act (CROA). This law protects consumers from deceptive practices. So, ensure the company follows legal guidelines to avoid companies that use illegal methods.

7. Evaluate the Company’s Longevity

Companies that have been around for several years have likely built a solid reputation. This suggests they have experience and credibility. Evaluating a company’s longevity helps you choose a well-established and trusted provider.

8. Look for Customized Solutions

Every credit situation is unique. Companies that offer personalized plans tailored to your specific needs are more likely to be effective. Customized solutions provide targeted strategies to improve your credit.

9. Understand Their Dispute Process

The dispute process is a core component of credit repair. Understanding how the company handles disputes with credit bureaus and creditors is crucial. This ensures the process is thorough and effective.

10. Check for Additional Financial Services

Some credit repair companies offer additional financial services like debt management or credit counseling. These services can provide comprehensive support for your financial health. This ensures you receive well-rounded support for improving and maintaining your credit.

11. Check for a Money-Back Guarantee

A money-back guarantee shows the company’s confidence in their services. This gives you peace of mind, knowing you can get a refund if you are not satisfied with the results.

A guarantee also indicates the company’s commitment to your success. If a company offers this, it reduces your financial risk and adds an extra layer of trust.

12. Look for Free Consultations

Free consultations allow you to assess the company’s services before committing. This helps you determine if their approach aligns with your needs.

Conclusion

Credit repair companies help you improve your credit score. A better credit score opens doors to lower interest rates and more financial opportunities.

However, not all companies offer the same level of services. You should pick the right one to save you time and money.

Look for one with a proven track record and positive customer reviews. This way, you can trust that they will handle your credit issues professionally and efficiently.

If you like this article, share it with your friends and family. They might be facing similar financial challenges.

Frequently Asked Questions

Q1. What Do Credit Repair Companies Do?

Credit repair companies help improve your credit score. They review your credit reports and identify errors. These errors could include inaccurate personal information, wrong account details, or outdated entries.

The company disputes these errors with the credit bureaus on your behalf. They also provide advice on how to manage your credit better. Their goal is to boost your credit score by ensuring your report is accurate.

Q2. How Long Does Credit Repair Take?

Credit repair is not instant. The time it takes depends on your specific situation. Disputing errors can take 30 to 45 days.

If your credit has many issues, the process might take several months. So patience is key. Credit repair companies often provide updates on their progress.

Q3. Can You Repair Your Credit Alone?

Yes, you can repair your credit on your own. It requires time, patience, and diligence. First, get copies of your credit reports from the three major bureaus: Experian, Equifax, and TransUnion.

Review them carefully for errors. Dispute any inaccuracies you find. This can be done online, by phone, or by mail. You should also work on paying down debt and making payments on time. It’s a DIY approach, but it can be effective.

Q4. Are Credit Repair Companies Legitimate?

Many credit repair companies are legitimate, but you should be cautious. Some companies make false promises or charge high fees for minimal results. Research any company thoroughly before signing up.

Q5. How Much Do Credit Repair Companies Charge?

Costs vary between companies. Some charge a flat fee, while others have monthly plans. Fees can range from $50 to $150 per month.

Be wary of companies that demand a large upfront fee. The Credit Repair Organizations Act (CROA) prohibits credit repair companies from charging for services before they are performed.

Q6. What Should You Look For In a Credit Repair Company?

Look for transparency and good customer service. A good company will explain their process clearly. They should provide a detailed contract outlining their services and fees.

Also, look for their:

- Track record

- Customer reviews

- Ratings

- Money-back guarantee

- Accreditation status

Q7. Will Credit Repair Companies Remove All Negative Information?

No, they can’t remove accurate negative information. Only incorrect or outdated entries can be disputed and potentially removed. Accurate negative information will stay on your credit report for seven to ten years.

Credit repair companies can help you understand what can be disputed. They can also provide strategies to improve your credit score over time. Always be wary of companies that promise to remove legitimate negative items.

Q8. How Do Credit Repair Companies Dispute Errors?

They start by obtaining your credit reports from the major credit bureaus. Then, they review your reports for any inaccuracies. Once they identify errors, they draft dispute letters on your behalf.

These letters are sent to the credit bureaus. The bureaus then investigate the disputes. If they find the information is incorrect, they will correct it. The process is repeated until your credit reports are accurate.